How to Find Medical Financial Assistance

Contents

- How to find medical financial assistance

- How to apply for medical financial assistance

- How to qualify for medical financial assistance

- How to receive medical financial assistance

- How to use medical financial assistance

- How to renew medical financial assistance

- How to report changes for medical financial assistance

- How to appeal a decision for medical financial assistance

- How to end medical financial assistance

- How to find other financial assistance programs

If you’re struggling to pay your medical bills you may be wondering how to find financial assistance. There are a number of options available, and the best way to find out what’s available to you is to do some research. Here are a few ideas to get you started.

Checkout this video:

How to find medical financial assistance

There are many ways to get help with medical bills. Depending on your income and assets, you may be eligible for free or low-cost care through government programs, or you may be able to work out a payment plan with your health care provider.

If you’re struggling to pay your medical bills, here are a few places to start:

1. Contact your health care provider: Many providers will offer financial assistance or payment plans for patients who are struggling to pay their bills. If you’re not sure whether your provider offers this type of assistance, ask to speak with a customer service representative or financial counselor.

2. Look into government programs: If you meet certain income and asset guidelines, you may be eligible for free or low-cost health care through programs like Medicaid or the Children’s health insurance Program (CHIP). To find out if you qualify, contact your state’s Medicaid office or the CHIP program in your state.

3. Search for charities: There are a number of charities that provide financial assistance for medical bills. Some organizations focus on specific conditions or diseases, while others provide general assistance. To find a charity that can help you, search online or ask your health care provider for recommendations.

4. Consider crowdfunding: Crowdfunding platforms like GoFundMe can be used to raise money for medical expenses. If you decide to start a campaign, be sure to set up a realistic fundraising goal and share your story in an engaging way.

5. Apply for loans: If you have good credit, you may be able to take out a loan to cover your medical bills. personal loans tend to have lower interest rates than credit cards, so this could be a more affordable option than charging your expenses to a credit card.

How to apply for medical financial assistance

When you’re facing a serious medical condition, the last thing you want to worry about is how to pay for treatment. But if you don’t have insurance or your treatment is not covered by your plan, the cost can be overwhelming.

Fortunately, there are programs that can help you cover the cost of medical care. Here’s how to find and apply for medical financial assistance.

1. Check with your hospital or treatment center. Many hospitals have financial assistance programs to help patients with the cost of care. Some programs are based on income, others are need-based. And some programs may only cover certain types of care, such as cancer treatment or emergency services.

2. Search online for medical financial assistance programs. There are many private and government-sponsored programs that can help with the cost of medical care. Programs may be based on income, need, or type of condition.

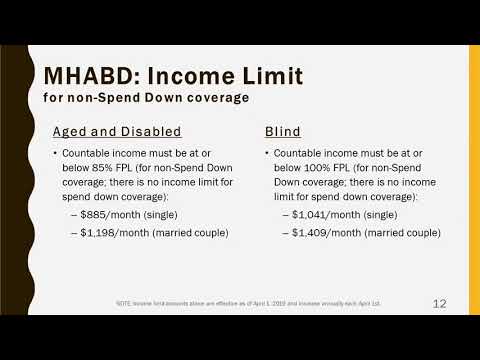

3. Contact your state’s Medicaid office. Medicaid is a government-funded health insurance program for low-income individuals and families. Each state has different eligibility requirements, so contact your state’s office to see if you qualify.

4., Apply for a hardship exemption from your health insurance company., If you have a health insurance plan through the Marketplace and you’re unable to afford your premiums, you may qualify for a hardship exemption that will allow you to suspend your payments for a period of time.,

5., Ask about discounts., If you’re unable to pay your entire bill upfront, some hospitals and treatment centers will offer discounts if you agree to make regular payments over time.,

6., Get help from a medical billing advocate., If you’re still struggling to understand or pay your medical bills, consider hiring a medical billing advocate who can help negotiate with providers on your behalf.,

7., Seek out free or low-cost clinics in your area.. If you don’t have insurance and can’t afford to pay for care, there may be free or low-cost clinics in your area that can provide basic services such as primary care, vaccinations, and screenings,,

Medical financial assistance programs can help reduce the cost of care if you don’t have insurance or your treatment is not covered by your plan. These programs may be based on income, need, or type of condition.

How to qualify for medical financial assistance

There are a few ways to qualify for medical financial assistance. The first way is to have a low income. You can show this by providing tax documents or pay stubs. The second way is to have a high medical bill. You can show this by providing a bill from your hospital or doctor. The third way is to have a disability. You can show this by providing a doctor’s note.

How to receive medical financial assistance

If you are overwhelmed with medical bills, you are not alone. According to a study done by the Kaiser Family Foundation, approximately one in five Americans struggled to pay their medical bills in the last year. For many people, this means making tough choices between paying for rent, food, or their healthcare.

Fortunately, there are options available to help you pay your medical bills. Here are a few ideas to get you started:

1. Look into government assistance programs. Depending on your income and other factors, you may be eligible for assistance from programs like Medicaid or Medicare.

2. Research charities and non-profit organizations that provide financial assistance for medical expenses. There are many organizations that can help if you meet their eligibility requirements.

3. Check with your hospital or other healthcare providers to see if they offer any financial assistance programs. Many hospitals have programs that can help patients with their medical bills.

4. Negotiate with your medical providers. If you are unable to pay your entire bill at once, try negotiating a payment plan with your provider. This can be an effective way to make sure you get the care you need without breaking the bank.

5. Use crowdfunding platforms to solicit donations from family and friends. Sites like GoFundMe or YouCaring can be helpful in raising money to cover unexpected medical expenses

How to use medical financial assistance

If you have a low income and are struggling to pay your medical bills, you may be eligible for medical financial assistance. Medical financial assistance is available from a variety of sources, including the government, charities, and religious organizations.

There are a few things you need to do to see if you qualify for medical financial assistance. First, gather up your most recent tax return, pay stubs, and medical bills. Next, contact your local or state social services office or human services department and ask if they have any programs that can help you with your medical bills. If they do not have any programs that can help you specifically with your medical bills, they may be able to refer you to other resources that can help you.

You can also contact national charities such as the Salvation Army or Catholic Charities USA. These organizations may have programs that can help you with your medical bills or they may know of other resources that can help you.

Finally, don’t forget to check with your religious organization. Many religious organizations have financial assistance programs that can help you with your medical bills.

If you need help paying for medical care, there are a variety of options available to you. Take the time to explore all of the options and find the one that best meets your needs.

How to renew medical financial assistance

If you need help paying for medical care, there are a few different ways to get financial assistance. You can apply for government assistance programs, such as Medicaid or Medicare. You can also look into private financial assistance programs offered by hospitals or other medical facilities.

If you already have financial assistance through Medicaid or Medicare, you will need to renew your coverage every year. The process for renewing your coverage may vary depending on the program, but it usually involves filling out an application and providing proof of your income and assets.

If you are not currently receiving financial assistance but think you may be eligible, the best way to find out is to contact your local Medicaid office or the Social Security Administration. They can help you determine if you qualify for any programs and walk you through the application process.

How to report changes for medical financial assistance

It is important to report any changes in your household circumstances to the agency that provides your medical financial assistance. Changes can include, but are not limited to:

-A change in your address or phone number

-A change in your family size

-A change in your income

-A change in your assets or savings

-A change in your job

How to appeal a decision for medical financial assistance

If you have been denied medical assistance or financial help for your medical care, you have the right to appeal the decision. You should first try to speak to the person who made the decision to see if they can explain why you were denied and what, if anything, you can do to qualify for assistance.

If you are still not satisfied with the decision, you can file an appeal. The appeals process will vary depending on the type of assistance you are seeking and the rules of the program. In general, however, you will need to submit a written request for an appeal within a certain time period (usually 30 days). Include any new information that may support your case, such as a change in income or family situation.

Your appeal will be reviewed by someone who did not make the original decision. They will look at all of the information again and may talk to you or other people involved in your case. Once they have all the information they need, they will make a new decision about your eligibility for medical assistance.

How to end medical financial assistance

Medical billing and coding can be confusing, but there are a few ways to get help paying your medical bills. Here are some options to explore.

1. Talk to your doctor or hospital about financial assistance programs. Many hospitals and doctors offer financial assistance programs (FAPs) to help patients with the cost of their care.

2. Look for free or low-cost clinics in your area. There are often free or low-cost clinics available to help people with their medical needs.

3. Check into government assistance programs. There are a number of government assistance programs available to help people with their medical bills.

4. Use crowdfunding sites to raise money for your medical expenses. Crowdfunding sites like GoFundMe can be a great way to raise money for medical expenses.

5. Negotiate with your doctor or hospital about the cost of your care. It’s important to remember that you have the right to negotiate the cost of your care with your doctor or hospital.

How to find other financial assistance programs

There are several ways to find other financial assistance programs. You can:

-Talk to your hospital or doctor’s office social worker.

-Look for local and national charities that offer financial assistance for medical bills.

-Check with your state’s social services agency.

-Look for help from religious organizations.

-Ask family and friends for help.