Financial Assistance Programs for Medical Bills

Contents [show]

Many people are struggling to pay their medical bills. There are various financial assistance programs available to help with the costs.

Checkout this video:

Government financial assistance programs for medical bills

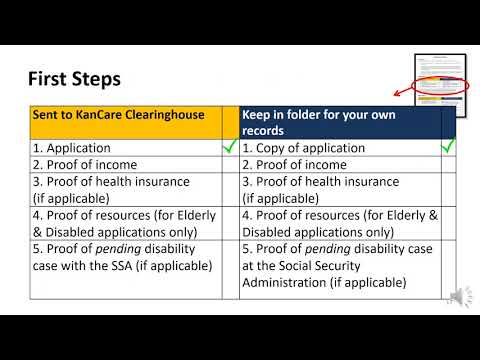

There are several government financial assistance programs that can help with medical bills. The two main programs are Medicaid and the Children’s health insurance Program (CHIP).

Medicaid is a state and federal joint program that helps low-income adults and children pay for medical care. Eligibility for Medicaid is based on income, family size, and other factors. CHIP is a federal program that helps low-income children who do not qualify for Medicaid get health coverage.

Other government programs that may be able to help with medical bills include the following:

-The Veterans Health Administration provides health care services to veterans of the US Armed Forces.

-The Bureau of Primary Health Care offers funding to community health centers across the country. These centers provide free or low-cost health care services to low-income patients.

-The Indian Health Service provides health care services to American Indians and Alaska Natives.

Charitable organizations that help with medical bills

There are several charitable organizations that help with medical bills. Here are a few of them:

-The HealthWell Foundation provides financial assistance to eligible individuals to help cover the costs of their medical care.

-MEDA (Medical Assistance) is a national non-profit organization that helps families pay for medical care and treatment.

-The National Association of Free and Charitable Clinics provides free or low-cost health care to those who cannot afford it.

Crowdfunding platforms for medical expenses

Crowdfunding platforms have become increasingly popular in recent years as a means of providing financial assistance for medical bills and other expenses. There are a number of different platforms to choose from, each with its own benefits and drawbacks.

One popular platform is GoFundMe, which allows users to set up a personal fundraising campaign for themselves or a loved one. GoFundMe campaigns are typically shared on social media and through email, and donors can give any amount they choose. The platform does charge a 2.9% processing fee, as well as a $0.30 fee per donation.

Another popular option is YouCaring, which offers both personal and nonprofit fundraising campaigns. Like GoFundMe, YouCaring does charge fees for use of the platform; however, these fees are generally lower than those of other crowdfunding platforms. YouCaring also allows donors to give anonymously if they wish.

When choosing a crowdfunding platform, it is important to consider the fees involved as well as the campaign types offered. Some platforms may be better suited to your needs than others, so it is important to do your research before making a decision.

Negotiating with medical providers

One common way to reduce the amount you owe for medical care is to negotiate with your provider. Although it may seem intimidating, many providers are willing to work with patients on payment arrangements, especially if the patient is able to pay a certain amount up front.

Some providers may be willing to give a discount if the bill is paid in full within a certain period of time. Others may be willing to set up a payment plan where you make smaller payments over a longer period of time. Some providers may also be willing to waive late fees or interest charges.

It’s important to remember that every provider is different, and they may not all be open to negotiation. It’s always worth asking, though, as you may be surprised at what you can save.

Medical bill assistance from employers

Many employers offer financial assistance programs to help employees with medical bills. These programs can vary significantly in terms of the amount of assistance they provide and the conditions under which they provide it. Some employers may offer a lump sum to help cover the costs of an employee’s medical treatment, while others may provide ongoing assistance with monthly payments. Some programs may require employees to meet certain criteria, such as being employed for a certain amount of time, while others may be available to all employees regardless of tenure.

If you’re facing high medical bills, it’s worth checking with your employer to see if they offer any type of financial assistance program. Even if your employer doesn’t have an official program in place, they may still be willing to work with you on a case-by-case basis. If you don’t feel comfortable asking your employer directly, you can also check with your human resources department to see if they are aware of any programs or policies that might help you with your medical bills.

Getting help from family and friends

When you’re struggling to pay your medical bills, it can be tough to ask for help. But if you have a supportive network of family and friends, they may be willing to lend a hand.

There are a few things to keep in mind if you’re considering asking for financial assistance from loved ones:

-Be clear about what you need. Do you need help with a one-time bill, or are you looking for ongoing assistance?

-Have a plan. Show your loved ones how you’re going to use the money and how you’ll pay them back.

-Be prepared for rejection. Not everyone will be able to help, and that’s OK.

-Don’t be afraid to ask. The worst that can happen is that someone says no. But if they say yes, it could make a world of difference.

Using credit cards or loans for medical bills

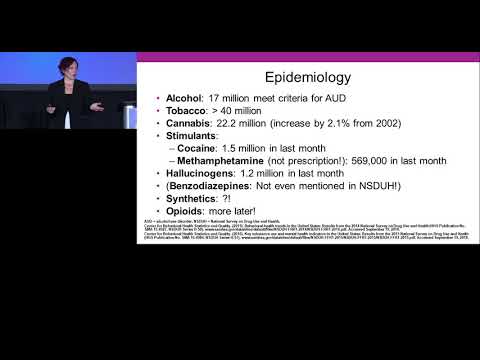

Medical bills can be one of the most stressful financial burdens a person can face. If you’re struggling to pay off your medical debt, you’re not alone. According to a report from the Kaiser Family Foundation, nearly 40 percent of adults in the United States say they have difficulty paying their medical bills, and more than 20 percent say they have had problems paying for medical care in the past year.

One option for dealing with medical debt is to use credit cards or loans to pay off the bills. However, this can be a risky proposition, as you may end up paying more in interest and fees than you would if you simply paid the bills on your own. Additionally, if you are unable to make your payments on time, your credit score could suffer.

If you’re facing medical debt, there are a number of financial assistance programs that can help you pay your bills. These programs can provide grants or low-interest loans to help cover the cost of your medical care. You may also be eligible for assistance from your state or local government, or from nonprofit organizations.

Medical Debt Relief is a nonprofit organization that provides financial assistance to people with medical debt. The organization offers grants and low-interest loans to help cover the cost of medical care. To learn more about Medical Debt Relief, visit their website at www.medicaldebtrelief.org.

The National Institutes of Health also offers a number of financial assistance programs for people with medical debt. For more information about these programs, visit their website at www.nih.gov/financialassistance/.

Selling possessions to pay for medical bills

No one should have to choose between receiving medical care and going bankrupt. However, hospital bills are one of the leading causes of bankruptcy in the United States. If you or a loved one is facing a mountain of medical debt, you may be wondering what options are available to you.

One option is to sell some of your possessions in order to come up with the cash to pay off your debts. This can be a difficult decision to make, but it may be necessary if you do not have any other source of funding. You may also want to consider selling possessions that you no longer need or use in order to free up some extra cash.

Another option is to look into financial assistance programs that can help you pay off your medical bills. Many hospitals and other healthcare providers offer financial assistance programs for those who are unable to pay their bills in full. These programs can provide discounts of up to 100% on your bill, depending on your individual circumstances.

If you are struggling to pay off medical bills, there are options available to you. Selling possessions and/or looking into financial assistance programs can help you get out of debt and on the road to financial recovery.

Filing for bankruptcy due to medical debt

According to a study conducted by the Kaiser Family Foundation, 62% of Americans said they or someone in their household struggled to pay medical bills in the past year. That’s not surprising when you consider that, on average, a family of four now pays more than $28,000 a year for health care, and premiums for employer-sponsored family health insurance have increased nearly 5% annually for the last five years.

With medical costs rising faster than wages, it’s no wonder that an estimated 2 million Americans file for bankruptcy each year due largely to mounting medical debt.

If you’re struggling to pay your medical bills, you’re not alone. But there are options available to help you get out of debt and back on your feet. Here are some financial assistance programs that can help you with your medical bills:

1. Medicaid: This government-sponsored program provides health insurance coverage for low-income individuals and families. To see if you qualify, contact your state’s Medicaid office.

2. Children’s health insurance Program (CHIP): CHIP provides low-cost health coverage for children up to age 19 in families who earn too much money to qualify for Medicaid but can’t afford private health insurance coverage. To see if your child qualifies, contact your state’s CHIP office.

3. Social Security Disability Insurance (SSDI): If you’re unable to work due to a disabling condition, you may be eligible for SSDI benefits, which can help cover the cost of Clinical Social Workers (CSWs) who provide counseling services and help people manage their disability benefits effectively so they can maintain their quality of life despite their condition.. To see if you qualify, contact the Social Security Administration (SSA).

Tips for avoiding medical debt

No one wants to be in debt, especially when it comes to something as important as their health. Medical debt is a leading cause of bankruptcy in the United States, but there are steps you can take to avoid it.

The first step is to be proactive about your health and your finances. Make sure you understand your insurance plan and what it covers. If you don’t have insurance, research your options and find a plan that fits both your medical needs and your budget.

Next, be smart about how you use your health care benefits. If your doctor offers a cash discount for services, take advantage of it! You can also save money by using generic drugs instead of brand-name drugs, and by getting preventive care, which can help avoid more costly problems down the road.

If you do find yourself with medical debt, don’t panic. There are many options available to help you get out of debt and back on track financially. You can negotiate with your creditors, set up a payment plan, or even apply for financial assistance programs like Medicaid or the Children’s health insurance Program (CHIP).

No matter what situation you’re in, there is help available. By taking some time to research your options and make a plan, you can avoid medical debt and keep your finances healthy.