Down Payment Assistance for Medical Professionals

Contents [show]

If you’re a medical professional looking for down payment assistance, you’ve come to the right place. Here, you’ll find all the information you need to know about programs that can help you buy a home.

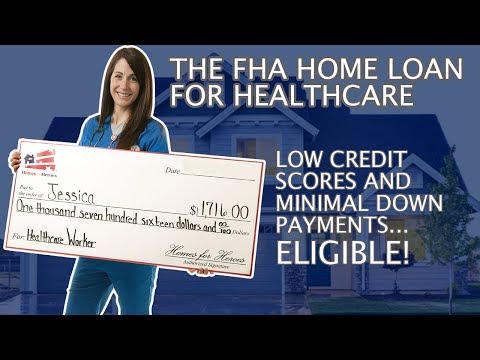

Checkout this video:

What is down payment assistance for medical professionals?

There are numerous programs that offer down payment assistance for Medical professionals These programs are typically offered by state or local governments, and they usually come in the form of grants or low-interest loans.

The amount of assistance that you can receive will vary from program to program, but it typically ranges from a few thousand dollars to tens of thousands of dollars. Down payment assistance can be used for a variety of expenses, including the down payment on a home, the purchase of a new car, or the starting of a new business.

If you are a medical professional who is looking for help with making a down payment, there are many resources available to you. You can start your search by contacting your state or local government to see if there are any programs available in your area. You can also search online for down payment assistance programs that are available nationally.

How can down payment assistance for medical professionals help you save money?

Down payment assistance for medical professionals can be a great way to save money when buying a home. Often, medical professionals are able to get discounts on their mortgage interest rates and on their down payments. This can help you save thousands of dollars over the life of your loan.

What are the eligibility requirements for down payment assistance for medical professionals?

There are a few eligibility requirements for down payment assistance for medical professionals. Firstly, you must be employed as a full-time medical professional. Secondly, you must have a minimum credit score of 640. Lastly, you must have a debt-to-income ratio below 45%. If you meet all of these requirements, you may be eligible for down payment assistance.

How to apply for down payment assistance for medical professionals?

Medical professionals are always in high demand and are crucial for maintaining the health and well-being of our society. Despite this, many medical professionals find it difficult to secure the necessary financing to purchase a home. However, there are a number of down payment assistance programs available specifically for medical professionals.

To apply for down payment assistance, medical professionals should first check with their state or local housing finance agency to see what programs are available. Additionally, many hospitals and health systems offer their own down payment assistance programs for employees. Once you have found a program that you are eligible for, you will need to submit an application which typically includes documentation of your financial situation, employment history, and education.

Down payment assistance programs can offer a significant boost for medical professionals looking to purchase a home. With these programs, you may be able to get help with a portion of your down payment, allowing you to stretch your budget and make homeownership more achievable.

What are the benefits of down payment assistance for medical professionals?

There are many benefits of down payment assistance for medical professionals. One benefit is that it can help you save money on your home purchase. Another benefit is that it can help you become a homeowner sooner than you might otherwise be able to. Finally, down payment assistance can help you avoid some of the risks associated with buying a home, such as the risk of being foreclosed upon or having your home go into foreclosure.

What are the drawbacks of down payment assistance for medical professionals?

There are several drawback of down payment assistance for medical professionals. One is that it can take years to pay off the debt, another is that you will have to pay interest on the money you borrowed, and lastly, you may be required to make a balloon payment at the end of the loan.

How to make the most of down payment assistance for medical professionals?

Buying a home is a big investment, and for medical professionals, it can be even more challenging to come up with the necessary down payment. However, there are many down payment assistance programs available that can help you cover the cost of your new home.

When you’re looking for a down payment assistance program, it’s important to compare your options and choose the one that best suits your needs. Some programs may offer a lower interest rate, while others may have no interest at all. Be sure to carefully consider all of your options before making a decision.

If you’re a medical professional, there are many down payment assistance programs available that can help you cover the cost of your new home. Be sure to compare your options and choose the one that best suits your needs.

What to do if you’re not eligible for down payment assistance for medical professionals?

If you’re not eligible for down payment assistance for medical professionals, there are still other options available to help you with the purchase of your home. You may want to consider a loan from family or friends, a home equity loan, or a personal loan. You can also look into state and federal grant programs that may offer down payment assistance.

How to find down payment assistance for medical professionals programs in your area?

In order to attract and retain a strong medical workforce, many communities offer down payment assistance for medical professionals programs. These programs provide forgivable loans or grants to help cover the down payment and/or closing costs of a medical professional’s primary residence.

There are a number of ways to find down payment assistance for medical professionals programs in your area. You can start by contacting your state’s medical licensing board or searching online for “down payment assistance for medical professionals [your state].” Additionally, many hospitals, clinics, and local health departments offer these types of programs.

If you are unable to find a program in your immediate area, consider searching in nearby communities or states. Some down payment assistance for medical professionals programs are offered on a regional or statewide basis. For example, the North Carolina health care Workforce Housing Program provides forgivable loans of up to $50,000 to eligible physicians, dentists, nurse practitioners and physician assistants who agree to practice in underserved areas of the state.

Before you apply for any type of loan or grant, be sure to research the terms and conditions carefully. Some programs require that you work in a specific location for a certain period of time in order to qualify for loan forgiveness, while others may have restrictions on how you can use the funds. Additionally, some programs may only be available to certain types of medical professionals or those who work in specific fields (e.g., primary care).

Contacting your state’s medical licensing board or searching online are great starting points for finding down payment assistance for medical professionals programs in your area.

What are some tips for making the most of down payment assistance for medical professionals?

There are a number of ways that medical professionals can make the most of down payment assistance programs. Here are a few tips:

-Don’t wait until you’ve found your dream home to start looking for down payment assistance. Many programs have limited funds and operate on a first-come, first-served basis.

– Be prepared to complete a lot of paperwork. Down payment assistance programs often require extensive documentation, including proof of income, employment, and assets.

– Ask your real estate agent or lender about down payment assistance programs that may be available in your area. They may be able to point you in the right direction.

– Check with your state or local housing finance agency to see if they offer any down payment assistance programs for medical professionals.

Making the most of down payment assistance programs can help you buy your dream home sooner than you thought possible. With a little research and preparation, you can take advantage of these programs and get into your new home with less financial stress.