Medical Professional Home Loans

Contents [show]

Medical professionals are often in high demand and have to travel a lot. This can be difficult on their families and their finances, especially if they don’t have the means to support them. Medical professionals need home loans that will help them manage work-life balance while continuing to provide for their family.

The medical professional home loan programs are a type of mortgage that is designed to help medical professionals with the down payment and closing costs associated with purchasing a home.

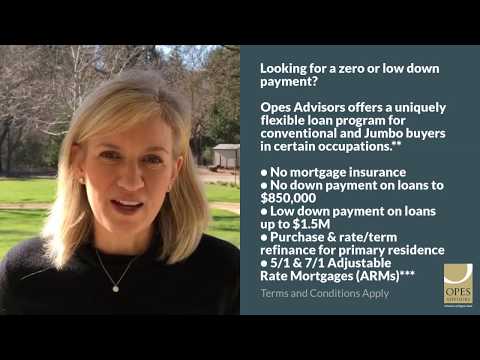

This Video Should Help:

Introduction to medical professional home loans

Medical professional home loans are a type of mortgage designed specifically for physicians, dentists, veterinarians, and other medical professionals. If you are in the process of becoming a medical professional or are already established in your career, you may be wondering if this type of loan is right for you. Here is an overview of medical professional home loans to help you make an informed decision.

One of the biggest benefits of medical professional home loans is that they often come with lower interest rates than traditional mortgages. This can save you thousands of dollars over the life of your loan and make it easier to afford your dream home. Another advantage of these loans is that they often have shorter repayment terms than conventional mortgages, which can also save you money in the long run.

Another consideration when deciding if a medical professional home loan is right for you is whether or not you will be able to qualify. While these loans are designed for medical professionals, there are still some credit and income requirements that must be met in order to qualify. However, if you do not have perfect credit or meet all of the income requirements, there are still options available to you. There are numerous lenders who offer programs for less-than-perfect credit borrowers, and there are also government-sponsored programs that can help you qualify for a loan even if you do not have perfect credit.

If you are looking for a way to finance your new home purchase and save money at the same time, a medical professional home loan may be right for you. Be sure to compare interest rates and repayment terms before selecting a loan so that you can find the best deal possible.

Who is eligible for a medical professional home loan?

Youufffdve dedicated years of your life to becoming a medical professional ufffd now itufffds time to find the perfect home for you and your family. But what kind of loan should you get?

The first step in any home purchase is to determine how much you can afford to spend. Your lender will take into consideration your income, debts, and credit history to arrive at a loan amount that you can comfortably afford.

If you are a physician, doctor, or other medical professional, you may be eligible for a medical professional home loan. These loans are specifically designed for doctors and offer several advantages, such as:

-Lower interest rates

-Larger loan amounts

-Flexible qualifying criteria

If you are not a medical professional, you may still be able to qualify for an FHA loan. These loans are available to anyone who meets the qualifying criteria, which includes:

-A minimum credit score of 580

-A down payment of 3.5% of the purchase price of the home

-A debt-to-income ratio of no more than 43%

The benefits of a medical professional home loan

There are a few specific benefits that come along with being a medical professional when youufffdre looking at taking out a loan, such as a physician mortgage or a doctor home loan. In some cases, you may be able to get a lower interest rate or have a larger sum of money borrowed.

VA loans are available to both active military personnel and veterans, and offer up to 100% financing with no monthly mortgage insurance premiums. To qualify, youufffdll need a valid Certificate of Eligibility from the VA. If you have any questions about whether you qualify, you can contact a loan specialist at New American Funding.

FHA loans are available to all qualified borrowers, and offer up to 96.5% financing with low down payment options. Mortgage insurance is required for all FHA loans, however, there are ways to get around it if you qualify for certain programs. You can learn more about that here.

Physician loans are also known as doctor loans or medical professional loans. They are specialized mortgages that usually offer up to 100% financing and sometimes have lower interest rates than other types of loans. If youufffdre a medical professional and looking for information on how to finance your home purchase, click here to learn more about physician mortgages and what New American Funding has to offer.

The different types of medical professional home loans

There are many different types of medical professional home loans available, so it’s important to choose the right one for your needs.

Physician loans are one type of loan that is available to medical professionals. These loans can be used for a variety of purposes, such as purchasing a home, refinancing an existing mortgage, or consolidating debt.

Doctors can also take advantage of FHA loans, which are government-backed mortgages that offer low down payment options and flexible credit requirements.

Other medical professionals such as dentists, veterinary professionals, and optometrists may also qualify for special mortgage programs.

How to apply for a medical professional home loan

If youufffdre a doctor, dentist, veterinarian or other medical professional, you may be wondering if you can get a special type of loan called a ufffdmedical professional home loan.ufffd While thereufffds no such thing as a ufffdmedical professional home loanufffd per se, there are special mortgage programs available for physicians and other medical professionals that offer significant advantages.

One of the best programs for medical professionals is the Federal Housing Administration (FHA) loan program. FHA loans are available to all borrowers, but they have special features that make them especially attractive to doctors and other medical professionals.

Here are some of the key features of FHA loans:

-Low down payment: You can get an FHA loan with as little as 3.5% down, which is much lower than the 20% down payment required for most conventional home loans.

-Flexible credit requirements: You can qualify for an FHA loan even if you have less-than-perfect credit, as long as your score is 580 or above.

-Low interest rates: FHA loans typically have lower interest rates than conventional home loans, making them more affordable on a monthly basis.

-Generous debt-to-income ratios: With an FHA loan, you can have a higher debt-to-income ratio than with a conventional loan, meaning you can borrow more money even if your monthly expenses are high.

If youufffdre a medical professional looking for a home loan, an FHA loan could be a good option for you. Talk to a lender about your options and see if an FHA loan is right for you.

The documents required for a medical professional home loan

If you are a medical professional looking for a loan to purchase a home, there are a few things you need to know. Medical professionals have unique circumstances when it comes to loan approval, and there are a few specialized loans available that take these circumstances into account. In general, you will need to provide additional documentation in order to get approved for a medical professional home loan.

Here are some of the documents you may be asked to provide:

-A copy of your medical license

-Proof of income (W-2 forms, tax returns, pay stubs)

-Proof of employment (letter from employer, contract)

-Asset statements (bank statements, investment account statements)

-Liability statements (credit card statements, student loan statements)

-Proof of residency (utility bills, lease agreement)

The interest rates for a medical professional home loan

There are a number of programs available to help medical professionals with the purchase of a home. The most common type of loan for physicians is a mortgage, and there are programs available through the Federal Housing Administration (FHA) that can help to make this process more affordable.

The interest rates for a medical professional home loan are typically lower than those for a traditional mortgage, and this can save you thousands of dollars over the life of the loan. There are also down payment assistance programs available that can help you to get into your new home with little or no money down.

If you are a medical professional looking for a home loan, be sure to compare interest rates and terms from a variety of lenders before making your decision.

The repayment options for a medical professional home loan

When it comes to repayment options for a medical professional home loan, there are a few things to keep in mind. For one, medical professionals have a few different loan programs available to them that have slightly different repayment terms. Additionally, medical professionals may also be eligible for programs that offer loan forgiveness or payment assistance

The most common loan programs for medical professionals are FHA loans and conventional loans. FHA loans typically have lower interest rates and down payment requirements than conventional loans, but they also require borrowers to pay mortgage insurance premiums. Medical professionals who are looking for repayment assistance may be able to qualify for programs like the Public Service Loan Forgiveness Program or the National Health Service Corps Loan Repayment Program.

The tax benefits of a medical professional home loan

There are many special loan programs available to medical professionals, but not all of them offer the same tax benefits. The most important thing to remember is that you should consult with a tax professional to determine which type of loan is best for your individual situation.

Some of the most popular medical professional home loans are through the Federal Housing Administration (FHA), which offers two different types of loans specifically for doctors. The first is the standard FHA loan, which allows for a down payment as low as 3.5%. The other option is the FHA Doctors Loan, which has special guidelines and benefits for physicians looking to purchase a home.

Another common type of medical professional home loan is a conventional mortgage. These loans typically require a higher down payment than FHA loans, but they also offer more flexible terms and lower interest rates. There are also a number of special programs available through conventional lenders that offer exclusive benefits for medical professionals.

No matter what type of loan you choose, there are several tax breaks that you may be eligible for as a medical professional. These include the interest paid on your mortgage, as well as any discount points that you pay to get a lower interest rate. You may also be able to deduct any private mortgage insurance (PMI) payments that you make each year.

Remember, itufffds always best to speak with a tax advisor or accountant before taking out any type of loan, especially if youufffdre not sure whether or not youufffdll be able to itemize your deductions on your tax return.

FAQs about medical professional home loans

1.What is a medical professional home loan?

A medical professional home loan is a mortgage loan that is specifically designed for physicians, dentists, and other medical professionals. These loans often have special terms and conditions that are favorable to medical professionals.

2. Who is eligible for a medical professional home loan?

In order to be eligible for a medical professional home loan, you must be a licensed physician, dentist, or other medical professional. You may also need to meet other requirements, such as having a certain minimum income.

3. What are the benefits of a medical professional home loan?

Medical professional home loans often have favorable terms and conditions, such as low interest rates and special repayment options. These loans can help you save money on your mortgage payments and make it easier to afford your dream home.

4. How do I apply for a medical professional home loan?

You can start by talking to a lender that offers these types of loans. Be sure to ask about the specific requirements and terms of the loan before you apply.