How to Get Medical Bill Assistance for COVID-19

Contents [show]

If you’re struggling to pay your medical bills because of the financial impact of COVID-19, you’re not alone. Here’s how to get assistance.

Checkout this video:

Introduction

If you’re worried about how you will pay your medical bills related to coronavirus (COVID-19), you’re not alone. Many people are struggling to pay for treatment and testing, as well as other related costs.

Fortunately, there is some financial assistance available. Here are a few ways you may be able to get help with your medical bills:

1. Contact your insurance company. If you have health insurance your provider may offer some relief, such as waiving co-pays and deductibles for treatment related to COVID-19. Be sure to check with your insurer to see what coverage they are offering.

2. Apply for government assistance. If you don’t have insurance or your coverage doesn’t cover all of your costs, you may be eligible for government assistance programs, such as Medicaid or the Children’s health insurance Program (CHIP). You can learn more about these programs and how to apply at Healthcare.gov.

3. Look into hospital financial assistance programs. Many hospitals offer financial assistance programs for those who cannot afford to pay their medical bills in full. To see if your hospital offers such a program, contact their billing office and ask about their policies.

4. Get help from charities and other organizations. There are many charitable organizations that may be able to help you pay your medical bills related to coronavirus. For example, the American Red Cross has set up a COVID-19 Emergency Financial Assistance Fund to help people with their medical expenses. To find out if you are eligible for assistance from these or other organizations, contact them directly or check their website for more information

What is medical bill assistance?

Medical bill assistance is help with paying for medical care. This can include help with medical bills that have already been incurred, or it can be assistance with paying for future medical care. There are a variety of ways to get help with medical bills, and the best way to find assistance is to contact a local or national organization that specializes in providing this type of assistance.

There are many organizations that provide financial assistance for medical bills, and each one has its own eligibility requirements and application process. Some of the more popular organizations that provide this type of assistance include:

-The American Red Cross

-The National Foundation for Credit Counseling

-Medical BillAssistance.org

When you contact an organization for financial assistance with medical bills, be sure to have all of your documentation ready. This documentation will likely include:

-Your most recent pay stubs

-Your most recent tax return

-A list of your current debts

-A list of your current assets

How can medical bill assistance help with COVID-19?

Medical bill assistance can help ease the financial burden of COVID-19 in a few different ways. For example, many hospitals and providers are offering extended payment plans or reduced rates for those affected by the pandemic. In addition, there are a number of charities and non-profit organizations that provide financial assistance to patients with medical bills. Finally, some state and federal government programs may also offer assistance for COVID-related medical expenses.

Who is eligible for medical bill assistance?

If you’ve been diagnosed with COVID-19, you may be eligible for medical bill assistance from the government. The CARES Act, enacted in March 2020, provides financial relief for Americans who have been diagnosed with the virus.

Under the CARES Act, eligible individuals can receive up to $1,200 in medical bill assistance. To be eligible, you must have a confirmed diagnosis of COVID-19 from a licensed health care provider. You must also be a US citizen or legal resident and have a valid Social Security number.

If you meet these criteria, you can apply for medical bill assistance by completing an application on the Federal Emergency Management Agency (FEMA) website. Once your application is approved, FEMA will send you a check or direct deposit the funds into your bank account.

If you need help paying your medical bills because of COVID-19, don’t delay in applying for assistance. The sooner you apply, the sooner you can get the financial help you need.

How to apply for medical bill assistance

The CARES Act has set up a $100 billion fund to help hospitals and other healthcare providers with the cost of caring for COVID-19 patients. The fund will reimburse providers for treatment costs, as well as lost revenue due to canceled elective procedures.

If you are struggling to pay your medical bills, you may be eligible for assistance from this fund. Here’s how to apply:

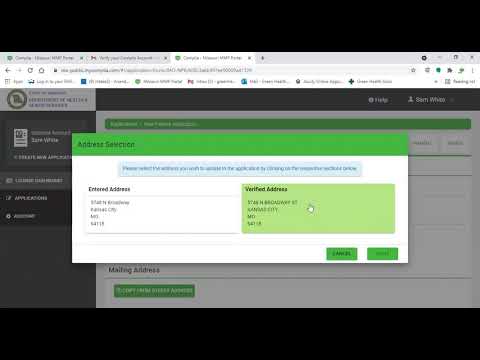

1. Contact your hospital or healthcare provider to see if they are participating in the program.

2. If they are, ask about the application process. You will likely need to submit documentation of your financial hardship and treatment costs.

3. Once your application is approved, the provider will submit a request for reimbursement to the CARES Act fund.

4. If approved, the provider will receive payment from the fund and will either bill you for the remaining balance or provide you with a discount on your bill.

If you have any questions about the process, be sure to ask your hospital or healthcare provider for more information.

What documentation is required for medical bill assistance?

If you are seeking medical bill assistance for COVID-19, you will need to provide documentation of your illness and treatment. This can include a positive test result, medical records from your provider, and bills from your hospital or other care facility. You may also need to provide proof of income and other financial information.

How long does it take to get medical bill assistance?

The time it takes to get medical bill assistance will vary depending on the type and amount of assistance you are seeking. For instance, if you are seeking government assistance, the process may take longer than if you are seeking assistance from a private organization. Additionally, the amount of time it will take to get medical bill assistance will also depend on factors such as your income and the number of bills you have.

What are the benefits of medical bill assistance?

There are many benefits of medical bill assistance, especially if you are struggling to pay off medical debt. Medical bill assistance can help you get out of debt faster, reduce the amount of interest you pay, and improve your credit score. If you have good credit, you may even be able to get a lower interest rate on a consolidation loan.

Are there any drawbacks to medical bill assistance?

Medical bill assistance programs can provide much-needed relief for people who are struggling to pay their medical bills. However, there are some potential drawbacks to these programs that you should be aware of before you apply for assistance.

First, medical bill assistance programs may require you to provide proof of financial need in order to qualify for assistance. This proof may include tax documents, pay stubs, or bank statements. If you do not have this documentation readily available, you may have to spend time gathering it before you can apply for assistance.

Second, medical bill assistance programs may only cover a portion of your total medical bills. For example, a program may only pay up to $500 per bill, no matter how high the bill is. This means that you may still be responsible for paying some of your medical bills even after you receive assistance from a program.

Third, medical bill assistance programs may have waiting periods before they will begin covering your bills. This means that if you have an urgent need for financial assistance, you may not be able to get it right away from a program.

Fourth, medical bill assistance programs may have limits on the types of bills they will cover. For example, a program may only cover hospital bills or doctor’s visits, but not prescription costs. Make sure you understand what types of bills a program will and will not cover before you apply for assistance.

Finally, keep in mind that medical bill assistance programs are often underfunded and have limited resources. This means that they may not be able to help everyone who applies for assistance. If you are denied help from one program, don’t give up – there are many other programs out there that may be able to help you.

Conclusion

We hope this guide has been helpful in understand what medical bill assistance options are available to help you during the COVID-19 pandemic. If you have any further questions, please don’t hesitate to reach out to our team of experts for assistance.