How to Calculate 2 Shareholder Health Insurance?

Contents

Are you a shareholder in a company that offers health insurance? Do you need to know how to calculate your health insurance costs? Here’s a quick guide on how to calculate your health insurance costs as a shareholder.

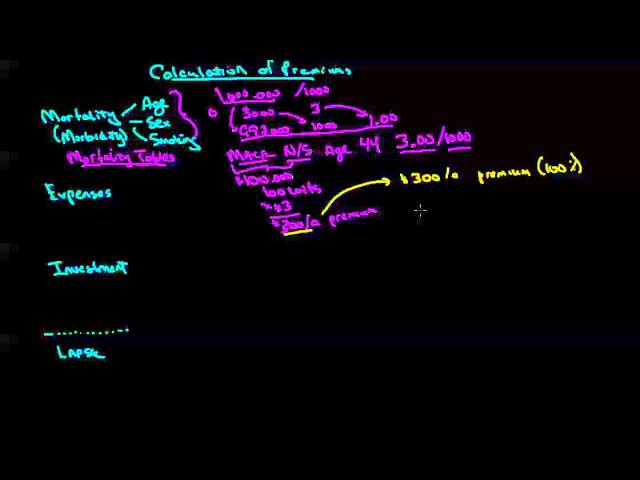

Checkout this video:

Introduction

In order to calculate the health insurance for two shareholders, you will need to know the following information:

The number of shareholders

The number of employees

The number of contractors

The number of part-time employees

Each shareholder’s ownership percentage

The total amount of money available to pay for health insurance premiums

This information will be used to calculate the amount of money each shareholder is responsible for in order to provide health insurance for all shareholders and employees.

Two shareholder health insurance is a type of policy that isOften used by small businesses to provide health insurance for business owners and their families. Two shareholder health insurance policies can either be community rated or experience rated. Community rated means that the premium price is the same for everyone in the group, regardless of their claims history or health status. Experience rated means that the premium price is based on the group’s claims history and health status.

There are a few steps you need to follow in order to calculate 2 shareholder health insurance. First, you need to find the total cost of health insurance coverage for both shareholders. Next, you need to divide this cost by the number of shares each shareholder owns. Finally, you need to multiply this number by the number of shares each shareholder owns.

Step 1: Determine the number of full-time equivalent employees

To start, you’ll need to determine the number of full-time equivalent employees (FTEs) you have. This is the total number of hours worked by all employees divided by 40. So, if you have two employees who work 30 hours per week each, that’s four FTEs.

You’ll also need to include any seasonal or part-time employees who work more than 120 days per year in your FTE count. So, if you have two employees who work 30 hours per week each for only four months out of the year, that’s still four FTEs.

Step 2: Determine the number of employees who work more than 30 hours per week

The number of employees who work more than 30 hours per week is important because these are the employees who must be offered health insurance under the Affordable Care Act (ACA). If you have 50 or fewer full-time equivalent employees, you are not subject to the employer shared responsibility provisions or the ACA’s health insurance marketplace rules.

Step 3: Determine the number of employees who work less than 30 hours per week

The next step is to determine the number of employees who work less than 30 hours per week. This is important because the Affordable Care Act (ACA) requires employers to offer health insurance to employees who work at least 30 hours per week. So, if you have any employees who work less than 30 hours per week, you will not be required to offer them health insurance.

After you have determined the number of employees who work less than 30 hours per week, you can move on to Step 4.

Conclusion

To calculate the two shareholder health insurance, you will need to gather some information. You will need the total number of employees, the total number of shareholders, and the number of shareholders who are also employees. You will also need to know the monthly cost of health insurance for each employee and shareholder. Once you have this information, you can use a simple formula to calculate the two shareholder health insurance.

The formula is: (Total Employees + Total Shareholders – 2Shareholders who are also Employees) x (Monthly Cost of Health Insurance for Each Employee + Monthly Cost of Health Insurance for Each Shareholder).

For example, if you have 10 employees and 10 shareholders, and two of those shareholders are also employees, you would use the following calculation: (10 + 10 – 2) x ($100 + $200). This would give you a total monthly cost of $3,000 for the two shareholder health insurance.