How Many People Loe Their Homes From Medical Debt in the U S?

Contents [show]

Similarly, What percent of US citizens have medical debt?

According to this examination of official statistics, 9 percent of individuals – or nearly 23 million people – owing more than $250 in medical bills. Approximately half of individuals with considerable medical debt owing more than $2,000 in total.

Also, it is asked, How many Americans have unpaid medical debt?

According to Affordable Health Insurance, one out of every four Americans has a medical debt of more than $10,000.

Secondly, How much medical debt does the average American have?

According to the Urban Institute, a nonprofit research group that mapped medical debt in the United States, Americans with medical debt in collections owe an average of $700.

Also, Does medical debt go away?

Medical debt takes seven years to remove from your credit record. Even afterwards, the debt never really disappears. Worrying about the credit bureaus is probably the last thing on your mind if you’ve just been in the hospital or had a bad medical visit.

People also ask, What is the number one cause of debt in the United States?

1) Health-Care Expenses According to a research published in the American Journal of Public Health in 2019, medical concerns such as being unable to pay large expenses or time away from work accounted for 66.5 percent of bankruptcies in the United States.

Related Questions and Answers

Which country has the most medical debt?

The United States boasts the world’s most costly healthcare system. The average cost of a medical consultation with a general practitioner is $190 (about €170). A hospital stay may result in costs in the tens of thousands, if not hundreds of thousands of dollars.

Why is medical debt so high?

Health-care expenses are rising faster than the economy, and businesses and people with commercial insurance bear a large chunk of the tab. Employers like Tom Savidge have to worry about how they’ll pay for their workplace insurance because of the high premiums. 7 September 2021

What happens if you don’t pay medical bills?

By suing you for the money you owe, the medical provider may get authorization from the court to place liens on your property, freeze your bank accounts, take your assets, and/or garnish your earnings.

How can I get my medical bills forgiven?

You may be eligible for medical bill debt forgiveness if you owe money to a hospital or healthcare provider. Income, family size, and other characteristics are usually used to determine eligibility. Even if you believe your salary is too high to qualify, inquire about debt forgiveness.

Are medical bills being removed from credit reports?

Removing medical debt from credit reports may help consumers improve their credit ratings. Paid medical debt in collections will no longer be reflected in credit reports starting in July. Medical collections debt under $500 will no longer be shown on credit reports in the first half of 2023, according to the credit bureaus.

Do medical bills fall off credit report after 7 years?

Medical debt may stay on your credit record for up to seven years.

What percentage of the population lives paycheck to paycheck?

According to a LendingClub research, 64 percent of the US population was living paycheck to paycheck at the start of 2022, up from 61 percent in December and just short of the peak of 65 percent in 2020. 8th of March, 2022

What is the average credit score for an American?

According to VantageScore® statistics from February 2021, the average credit score in the United States is 698. The idea that you only have one credit score is a misconception. You really have a lot of credit scores. Checking your credit ratings on a frequent basis is a smart practice.

How much credit card debt does the average person have?

In Q2 2021, the typical credit card customer in the United States had $5,668 in credit card debt, up 1% from the $5,611 average in Q1 2021. From the first quarter of 2020 to the second quarter of 2021, the average credit card debt per cardholder fell by $766, or 12%. In Q1 2020, the typical cardholder had $6,434 in their account.

Why U.S. healthcare is so expensive?

The cost of medical treatment is the single most important element driving healthcare expenditures in the United States, accounting for 90 percent of total spending. These costs represent the rising expense of caring for people with chronic or long-term medical illnesses, as well as the rising cost of new drugs, surgeries, and technology.

Is the US healthcare system the most expensive in the world?

Every year, the United States spends the most on healthcare per person. The United States spends more than $3,000 more per person than the second-highest nation, Switzerland, at $10,586 per person.

What country has the most affordable healthcare?

Here are five nations with some of the most cost-effective healthcare systems. Brazil. Brazil is a fantastic area to live for foreigners. Costa Rica is a country in Central America. Costa Rica has consistently been among the top nations in the world for life expectancy. Cuba. For foreigners, Cuba is constantly the focus of attention. Japan. Malaysia. 5th of December, 2020

What happens if you can’t afford healthcare in America?

A major injury or a health condition that requires emergency care and/or an expensive treatment plan without health insurance coverage may result in bad credit or even bankruptcy.

How many Americans have no health insurance?

According to the CBO, the number of uninsured Americans in 2020 will be approximately 31 million. 5th of March, 2022

Can you be blacklisted for medical bills?

Patients who are behind on their payments may be ‘blacklisted’ on a special list provided solely to general practitioners. This will have no impact on the patients’ overall creditworthiness. Patients who do not pay their bills, on the other hand, may face civil action.

Can you negotiate medical bills in collections?

You may be able to bargain down the amount of your medical bills on your own if you have medical bills in collections or believe you can take on the task of a medical bill advocate. Know that debt collectors acquire debts for pennies on the dollar when it comes to medical bills in collections.

Does medical debt affect credit score?

Because most healthcare providers do not report to the three national credit bureaus (Equifax, Experian, and TransUnion), most medical debt does not appear on credit reports and does not affect credit scores.

Do medical bills affect your credit when buying a house?

Yes, medical costs may have an impact on your credit when it comes to purchasing a home. medical expenses that are not paid have a negative impact on your credit record, lowering your credit score. Your chances of getting accepted for any form of loan, including a mortgage, will be hampered if you have a poor credit score.

Should I pay medical collections?

Pay off any bills that are past due. Paying off your medical collection account is a fantastic place to start when it comes to repairing your credit. Any other past-due bills should be brought current as quickly as feasible.

How do you write a hardship letter for medical bills?

Greetings, Sir or Madam: I’m writing to let you know that I’m unable to pay the above-mentioned bill (describe your condition and treatment). I got the included bill (along with a copy of the billing company’s paperwork), however I am unable to pay the payment as stated.

How do I get rid of medical collections?

Medical collections may be removed off your credit record in three ways: 1) Send a goodwill letter requesting relief, 2) Negotiate to have the medical bill reporting removed in exchange for cash (also known as a Pay For Delete), and 3) challenge the account until it is removed.

Conclusion

Watch This Video:

The “u.s. medical debt 2020” is a question that has been asked quite a few times. The answer to the question is “9,000,000”.

Related Tags

- u.s. medical debt 2021

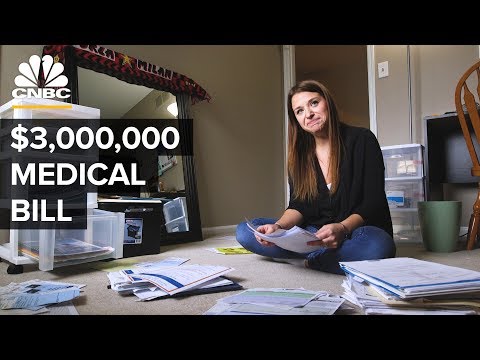

- u.s. medical bill example

- medical debt in the us, 2009-2020

- average american medical debt

- medical debt statistics 2020