Medical Financial Assistance for Those with Bad Credit

Contents [show]

Bad credit can make it difficult to get approved for medical financial assistance but there are a few options available. Follow our tips and learn more about how to get the help you need.

Checkout this video:

Introduction

There are many options available for those who need medical financial assistance but have bad credit. While some people may not qualify for traditional loans, there are still a number of ways to get the money you need.

One option is to look into government programs that offer assistance to those with bad credit. These programs are often designed to help people in financial need, and they may be able to help you cover the costs of your medical treatment.

Another option is to work with a hospital or other medical facility that offers financial assistance to those who need it. Many hospitals have programs in place that can help you pay for your treatment, even if you have bad credit. You may need to provide proof of your income and expenses, but these programs can be a great way to get the money you need to cover your medical costs.

You can also talk to your doctor or other medical professionals about payment plans or other options for financial assistance. Many doctors and other medical professionals are willing to work with you on a payment plan that fits your budget, and they may be able to help you find other sources of funding as well.

There are a number of ways to find medical financial assistance if you have bad credit. Talk to your doctor or other medical professionals, look into government programs, and consider working with a hospital or other medical facility that offers financial assistance. With a little research, you should be able to find the right solution for your needs.

What is bad credit?

There is no single definition of what counts as bad credit. Lenders will each have their own criteria, but generally speaking, a bad credit score is one that falls below 580 on the FICO®️ Score☉ 8 model. This is roughly equivalent to a VantageScore®️ 3.0 score of 300. A poor or fair credit score may make it difficult to get approved for loans, credit cards and other forms of financial assistance.

Bad credit can be the result of making late payments on your bills, carrying high balances on your credit cards or having a history of debt problems. It can also simply be the result of having little or no credit history at all. If you have bad credit, there are steps you can take to improve your score and make it easier to get approved for financial assistance in the future.

The effects of bad credit

Bad credit can have a number of negative effects on your life, including making it more difficult to get approved for loans, credit cards, and other types of financing. In addition, bad credit can also lead to higher interest rates and fees, and can even make it difficult to rent an apartment or get a job.

If you’re struggling with bad credit, there are a few things you can do to try to improve your situation. One option is to work with a credit counseling or repair service. These companies can help you negotiate with creditors and try to remove negative items from your credit report. Another option is to take out a bad credit loan, which is designed for people with poor credit. Bad Credit loans typically have higher interest rates and fees than regular loans, but they can still be a useful tool for rebuilding your credit.

If you’re considering taking out a bad credit loan, be sure to shop around and compare offers from multiple lenders. It’s also important to read the fine print carefully before signing any loan agreement, so that you understand the terms and conditions of the loan.

How to get medical financial assistance with bad credit

There are a number of ways to get medical financial assistance even if you have bad credit. One option is to look into government programs that may be available to you. Another option is to look into private charities or organizations that may be able to help you. There are also a number of medical financial assistance programs that are available through hospitals or other medical facilities. You may also want to consider looking into a personal loan from a bank or other financial institution.

Grants and loans for medical financial assistance

There are a number of grants and loans available for medical financial assistance, regardless of your credit score. The first step is to fill out a Free Application for Federal Student Aid (FAFSA). You can receive federal loans regardless of your credit score, and these loans generally have lower interest rates than private loans. You may also be eligible for grants, which do not need to be repaid.

If you do not qualify for federal loans or grants, or if you need additional funding, there are private loan options available. However, your interest rates will likely be higher and you may need a cosigner with good credit in order to qualify. There are also a number of medical financial assistance programs available through specific hospitals or other medical facilities. These programs typically have their own eligibility requirements, so be sure to check with the hospital or facility before applying.

Charities and non-profit organizations

There are many charities and non-profit organizations that offer financial assistance to those in need. If you have bad credit, you may still be able to qualify for assistance from these organizations. Some of the organizations that offer medical financial assistance include:

-The American Red Cross

-The Salvation Army

-Catholic Charities

-Jewish Federations of North America

-United Way

Crowdfunding

One option for covering medical bills when you have bad credit is to turn to crowdfunding. With this method, you use a website to solicit donations from family, friends, and even strangers to help pay for your bills. You’ll need to create a compelling story and set up a way for people to donate money. Keep in mind that you won’t get all of the money you raise; most crowdfunding platforms charge fees of around 5%.

Personal loans

If you are facing a medical emergency and have bad credit, you may be wondering if there is any financial assistance available to help you cover the costs. The good news is that there are several options for personal loans for those with bad credit.

One option is to apply for a loan through a traditional lender such as a bank or credit union. However, due to your bad credit, you may not be approved for a loan or you may be approved for a loan with less favorable terms than someone with good credit.

Another option is to apply for a loan through a company that specializes in loans for people with bad credit. These companies typically have liberal lending standards and may be more likely to approve your loan. However, these loans typically come with higher interest rates and fees than loans from traditional lenders.

There are also government programs that offer financial assistance to those with bad credit. These programs typically have more favorable terms than private loans but may have certain eligibility requirements that need to be met in order to qualify.

If you are facing a medical emergency and have bad credit, there are several options for personal loans that may be able to help you cover the costs. Talk to your doctor or financial advisor about which option would be best for your situation.

Credit cards

Applying for a credit card can be a difficult process if you have bad credit. However, there are a few options available that can help you get the financial assistance you need.

For starters, many credit card companies offer cards specifically designed for people with bad credit. These cards typically have lower limits and higher interest rates than traditional cards, but they can still help you build up your credit score.

Another option is to look into financial assistance programs offered by charities and non-profit organizations. These programs can help you get the money you need to pay for medical bills housing costs, or other necessary expenses.

Finally, consider asking family and friends for help. If you have people in your life who are willing and able to lend you money, they may be your best bet for getting the financial assistance you need.

Government assistance programs

There are various government assistance programs available for those with bad credit who need help with medical bills The programs vary in terms of what they cover and how much assistance they provide, but they can all be a great resource for those struggling to pay their medical bills

One of the most popular programs is the Low Income Home Energy Assistance Program (LIHEAP), which provides financial assistance to low-income households to help them pay their energy bills. This program is run by the federal government, and each state has its own version of it. LIHEAP can provide up to $1,000 per year in assistance, and it is available to those who meet certain income guidelines.

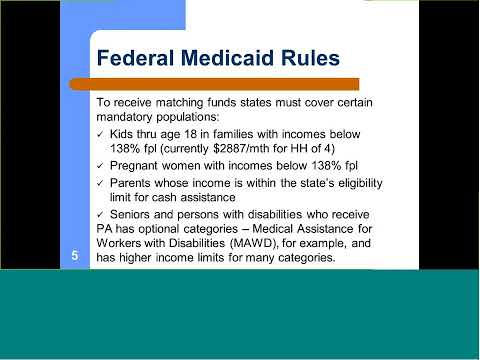

Another popular program is the Medicaid program, which provides health insurance coverage to low-income individuals and families. Medicaid is a joint federal-state program, and each state has its own eligibility requirements. In general, though, Medicaid covers a wide range of medical services and can be a great resource for those with bad credit who need help paying their medical bills.

There are also a number of private financial assistance programs that can help those with bad credit pay their medical bills. These programs are usually run by charities or other non-profit organizations, and they typically have their own eligibility requirements. However, many of these programs are willing to work with individuals on a case-by-case basis, so it’s worth reaching out to see if you qualify.

If you have bad credit and you’re struggling to pay your medical bills, there are a number of government and private assistance programs that can help you. reach out to see if you qualify for any of these programs.