Do You Need International Medical Assistance Insurance?

Contents

- What is International Medical Assistance Insurance?

- Do You Need International Medical Assistance Insurance?

- What Does International Medical Assistance Insurance Cover?

- How Much Does International Medical Assistance Insurance Cost?

- How to Get International Medical Assistance Insurance

- What to Look for in an International Medical Assistance Insurance Plan

- How International Medical Assistance Insurance Works

- International Medical Assistance Insurance and You

- The Benefits of International Medical Assistance Insurance

- Choosing the Right International Medical Assistance Insurance

Do you need international medical assistance insurance? Here are five factors to consider to help you make the best decision for your needs.

Checkout this video:

What is International Medical Assistance Insurance?

International Medical Assistance Insurance is insurance that provides coverage for medical expenses incurred while traveling outside of your home country. This type of insurance is also sometimes referred to as “global health insurance” or “international health insurance ”

There are a variety of different types of International Medical Assistance Insurance plans available, and the right plan for you will depend on a number of factors, including your travel destination(s), the length of your trip, and the type of medical coverage you are looking for. Some plans may also provide coverage for things like evacuation and repatriation expenses.

If you are planning to travel outside of your home country, it is important to research whether or not International Medical Assistance Insurance is right for you.

Do You Need International Medical Assistance Insurance?

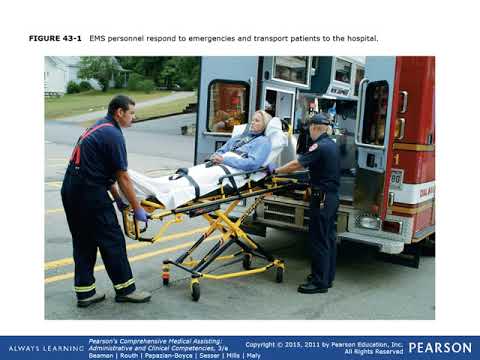

Medical assistance insurance is designed to cover the costs of medical care and emergency transportation if you get sick or injured while traveling outside your home country.

Most major credit card companies offer some level of medical assistance insurance as a benefit of using their card, and many travel insurance policies also include medical assistance coverage. If you have a health insurance policy that includes overseas coverage, you may not need to purchase additional medical assistance insurance.

Before you decide whether or not to purchase medical assistance insurance, research the coverage offered by your credit card company and travel insurance policy, and check with your health insurance provider to see what (if any) coverage they offer for overseas medical expenses.

What Does International Medical Assistance Insurance Cover?

Most insurance policies will not cover you if you are traveling outside of your home country, so it is important to purchase international medical assistance insurance if you are planning a trip overseas. This type of insurance will cover you for emergency medical expenses, evacuation, and repatriation. It is important to make sure that you are aware of the coverage limits of your policy and to choose a policy that will cover you for the entirety of your trip.

In addition to emergency medical expenses, international medical assistance insurance will also cover you in the event that you need to be evacuated from your location due to political unrest or natural disaster. This coverage can also provide for your repatriation in the event that you should become sick or injured and are unable to return home on your own.

When choosing an international medical assistance insurance policy, it is important to make sure that it covers you for the activities that you will be participating in while on your trip. For example, if you are planning on doing any adventurous activities, such as hiking or whitewater rafting, make sure that your policy includes coverage for these activities.

It is also important to remember that international medical assistance insurance is not the same as travel insurance. Travel insurance covers things like lost luggage and cancelled flights, while international medical assistance insurance focuses specifically on providing health care coverage while abroad.

If you are planning a trip overseas, make sure to purchase international medical assistance insurance in order to protect yourself from financial ruin in the event of an emergency.

How Much Does International Medical Assistance Insurance Cost?

There is no definitive answer to this question as the cost of international medical assistance insurance varies greatly depending on a number of factors, such as the country you are travelling to, the length of your trip, and the level of coverage you require. However, as a general rule of thumb, you can expect to pay somewhere in the region of $5-$15 per day for basic coverage. For more comprehensive coverage, which may includes things like evacuation and repatriation costs, you could be looking at a daily premium of $25 or more.

How to Get International Medical Assistance Insurance

There are a few different ways to get international medical assistance insurance. The most common way is to purchase a policy from a private insurer. You can also get coverage through certain credit cards and government-sponsored programs.

If you’re traveling to a country with a high risk of disease or injury, you may need to purchase international medical assistance insurance. This type of insurance covers the cost of medical evacuation and treatment in a foreign country. It can be purchased as part of a travel insurance policy or as a standalone policy.

Here’s how to get international medical assistance insurance:

– Purchase a policy from a private insurer: This is the most common way to get international medical assistance insurance. You can compare policies and prices online or through an insurance broker. Make sure you understand the coverage and exclusions before you purchase a policy.

– Get coverage through certain credit cards: Some credit cards offer international medical assistance insurance as part of their benefits package. Check with your card issuer to see if this coverage is available.

– Government-sponsored programs: Certain government programs, such as the Peace Corps, offer medical assistance insurance to members. If you’re enrolled in one of these programs, check to see if you’re covered.

What to Look for in an International Medical Assistance Insurance Plan

When considering international medical assistance insurance, there are a few key things to look for in a plan. First, you’ll want to make sure that the plan covers emergency medical evacuation and repatriation. This is critical in the event that you become sick or injured while traveling and need to be transported back to your home country for treatment.

Second, you’ll want to make sure that the plan covers emergency medical expenses. This includes things like hospitalization, doctor’s visits, and prescriptions. You’ll also want to make sure that the plan has good coverage for mental health services, in case you experience any type of trauma while traveling.

Finally, you’ll want to make sure that the plan has good customer service. This includes things like 24/7 customer support and a easy-to-use website or app. You’ll also want to make sure that the company is reputable and has a good reputation with customers.

How International Medical Assistance Insurance Works

International medical assistance insurance is a type of insurance that helps you pay for medical care and assistance while you are traveling outside of your home country. This type of insurance can help cover the cost of things like evacuation, hospitalization, and even repatriation (the process of returning home).

There are a few different types of international medical assistance insurance policies, and the one you need will depend on where you are traveling, how long you will be gone, and what kinds of activities you will be doing. For example, if you are going to be doing a lot of hiking in remote areas, you may want to get a policy that includes coverage for search and rescue operations.

Most international medical assistance insurance policies will cover emergency medical expenses, but they may also include other benefits like trip interruption or cancellation coverage, lost luggage protection, and more. Some policies even provide concierge services that can help you with things like making travel arrangements or getting recommendations for restaurants in your destination city.

Before you purchase an international medical assistance insurance policy, be sure to read the fine print so that you know exactly what is covered and what is not. You should also make sure that the policy you choose is from a reputable company with a good reputation for customer service.

International Medical Assistance Insurance and You

There are many different types of insurance available to travelers, and it can be difficult to determine which type is right for you. One type of insurance that may be beneficial for travelers is international medical assistance insurance.

International medical assistance insurance is designed to help cover the costs of medical care while you are traveling abroad. It can help cover the cost of transportation to a medical facility, as well as the cost of treatment while you are abroad.

Before purchasing international medical assistance insurance, there are a few things to consider. First, you will need to determine whether your health insurance will cover you while you are abroad. If it does not, then international medical assistance insurance may be a good option for you.

Next, you will need to decide what level of coverage you need. There are many different levels of coverage available, so it is important to choose the one that best meets your needs. You should also consider the cost of premiums when choosing a policy.

Finally, you will need to decide whether you want short-term or long-term coverage. Short-term coverage is typically less expensive than long-term coverage, but it may not provide as much protection. Long-term coverage may be more expensive, but it can provide more peace of mind knowing that you are covered for an extended period of time.

The Benefits of International Medical Assistance Insurance

There are many benefits to having international medical assistance insurance. First, if you are traveling outside of your home country, it can provide peace of mind in knowing that you will be covered in the event of an emergency.Second, it can help you avoid financial hardship if you need to receive medical treatment while abroad. Finally, it can give you access to a network of healthcare professionals who can provide assistance and guidance if you have a medical emergency while traveling.

Choosing the Right International Medical Assistance Insurance

There are many different factors to consider when choosing the right international medical assistance insurance for you and your family. Here are a few things to keep in mind:

-What type of coverage do you need?

-How long will you be traveling?

-What is your budget?

-What is the quality of the coverage?

-Is the company reputable?

Keep these factors in mind when shopping around for international medical assistance insurance so that you can find the best policy for your needs.