The Benefits of Supplemental Health Insurance for the Elderly

Contents

- Why supplemental health insurance is important for the elderly

- The benefits of supplemental health insurance for the elderly

- How supplemental health insurance can help cover expenses not covered by Medicare

- The different types of supplemental health insurance available for the elderly

- How to choose the right supplemental health insurance for your needs

- The importance of shopping around for supplemental health insurance

- How to compare supplemental health insurance plans

- The pros and cons of supplemental health insurance

- 10 things you need to know about supplemental health insurance

- How to get the most out of your supplemental health insurance

If you’re one of the many Americans over the age of 65, you may be wondering if you need supplemental health insurance Here’s a look at the benefits of supplemental health insurance for the elderly.

Checkout this video:

Why supplemental health insurance is important for the elderly

A supplemental health insurance policy is an insurance policy that provides coverage for expenses not covered by a regular health insurance policy. These policies are designed to fill in the gaps in coverage and help cover costs not covered by your regular health insurance

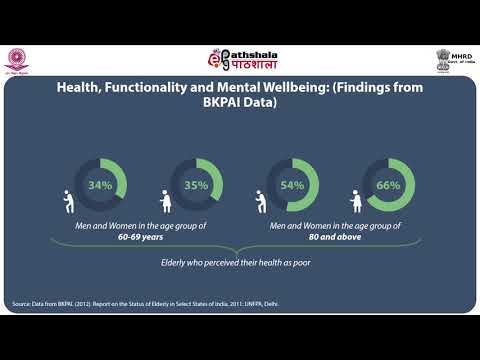

Supplemental health insurance is especially important for the elderly, as they are more likely to have chronic health conditions that are not covered by their regular health insurance. According to the Centers for Disease Control and Prevention (CDC), chronic conditions such as heart disease, stroke, cancer, and diabetes are among the leading causes of death and disability in the United States. These conditions are also among the most expensive to treat.

Supplemental health insurance can help cover the costs of treatment for these chronic conditions, as well as the costs of other elder care needs such as long-term care, home health care, and prescription drugs. Supplemental health insurance can also help pay for preventive care services such as screenings and immunizations, which can help keep seniors healthy and reduce their risk of developing a chronic condition.

The benefits of supplemental health insurance for the elderly

There are many benefits of supplemental health insurance for the elderly. With supplemental health insurance, the elderly can have access to better quality healthcare, and they can also get help with the costs of long-term care. In addition, supplemental health insurance can help the elderly stay independent and reduce their reliance on family members or the government for financial assistance.

How supplemental health insurance can help cover expenses not covered by Medicare

As people age, they become more susceptible to a variety of health problems. Many of these health problems are not covered by Medicare, the government-sponsored health insurance program for people age 65 and over. This is where supplemental health insurance comes in.

Supplemental health insurance is a type of insurance that covers expenses not covered by Medicare. This can include things like co-pays, deductibles, and prescription drugs. Supplementing Medicare with a supplemental health insurance policy can help cover the costs of medical care that Medicare doesn’t cover.

There are a variety of supplemental health insurance policies available, so it’s important to choose one that fits your needs and budget. Be sure to compare different policies before you purchase one, and make sure you understand what is and is not covered by your policy.

The different types of supplemental health insurance available for the elderly

There are a variety of supplemental health insurance plans available for the elderly, each with different benefits and coverage levels. Some supplemental health insurance plans for the elderly offer basic coverage for hospital and medical expenses, while others provide more comprehensive protection.

The most common type of supplemental health insurance for the elderly is Medicare supplement insurance. Medicare supplement insurance plans are designed to cover gaps in Medicare coverage, such as deductibles and copayments. Medicare supplement insurance plans are available from private insurers, and the federal government offers a Medicare supplement insurance plan, known as Medigap.

Other types of supplemental health insurance for the elderly include long-term care insurance, which covers the costs of nursing home care or in-home care; and dental and vision insurance, which covers the costs of routine dental and vision care.

How to choose the right supplemental health insurance for your needs

There are many types of supplemental health insurance available for seniors, and it can be difficult to decide which one is right for you. Here are some things to consider when choosing a policy:

-What type of coverage do you need?

-What is your budget?

-What is your current health situation?

-What are your future health plans?

Supplemental health insurance can be a great way to fill in the gaps in your regular health insurance coverage. It can help you pay for things like prescription drugs, dental care, and other out-of-pocket costs. If you are a senior citizen, supplemental health insurance can be a great way to make sure you have the coverage you need.

The importance of shopping around for supplemental health insurance

There are a number of important factors to consider when shopping for supplemental health insurance for the elderly. The most important factor is undoubtedly the cost of the policy. There are a number of ways to save money on supplemental health insurance, but the best way is to shop around and compare rates from a number of different companies.

Another important factor to consider is the coverage that the policy provides. It is important to make sure that the policy covers all of the basic needs that you or your loved one may have in the event of an accident or illness.

How to compare supplemental health insurance plans

When you’re comparing supplemental health insurance plans, it’s important to keep in mind what your needs are and what you’re looking for in a plan. Some things to consider include:

– Do you need prescription drug coverage?

– Do you need vision or dental coverage?

– Are there any doctors or hospitals you prefer to use?

– What is your budget for premiums and out-of-pocket costs?

Once you know what you need, you can start comparing plans. Here are a few things to look at when you’re comparing plans:

– Premiums: This is the amount you’ll pay every month for your coverage.

– Coverage: Make sure the plan covers the benefits you need.

– networks: Make sure the plan includes the doctors and hospitals you want to use.

– Costs: In addition to your monthly premium, there may be other costs, such as deductibles, coinsurance, and copayments. Be sure to factor these into your budget.

The pros and cons of supplemental health insurance

As we age, our health needs often change. While some seniors enjoy good health well into their golden years, others may start to experience more chronic health problems. Supplemental health insurance can help offset the costs of medications, treatments, and therapies that aren’t covered by Medicare. But is supplemental insurance right for you? Here are some pros and cons to consider:

Pros:

-Supplemental insurance can help cover the costs of medications, treatments, and therapies not covered by Medicare.

-It can help you pay for out-of-pocket expenses like deductibles and copayments.

-It can give you peace of mind in knowing that you have coverage if your health needs change.

Cons:

-Supplemental insurance can be expensive.

-It may not cover all of your health needs.

-You may still be responsible for paying deductibles and copayments.

10 things you need to know about supplemental health insurance

1. Medicare does not cover everything, and supplemental health insurance can help close the gaps in coverage.

2. Supplemental health insurance can help pay for out-of-pocket expenses like deductibles, copayments, and coinsurance.

3. Be sure to shop around and compare prices before you purchase a policy.

4. Review your policy carefully so that you understand what is and is not covered.

5. Make sure that your supplemental health insurance policy covers prescription drugs.

6. Consider getting supplemental health insurance if you have a pre-existing medical condition.

7. If you are 65 or older, you may be eligible for a discount on your premiums.

8. Be sure to read the fine print before you purchase a policy so that you are aware of any exclusions or limitations.

9. Keep in mind that supplemental health insurance is not the same as long-term care insurance.

How to get the most out of your supplemental health insurance

What is supplemental health insurance?

Supplemental health insurance is a type of insurance that helps cover the costs of medical care that are not covered by your regular health insurance. It can help cover the costs of things like co-pays, deductibles, and other out-of-pocket expenses.

How can supplemental health insurance help the elderly?

Supplemental health insurance can be especially helpful for the elderly. This is because as we age, we often face more medical challenges and our regular health insurance may not cover all of the costs associated with these challenges. Supplemental health insurance can help fill in the gaps and ensure that we have the coverage we need to maintain our health and well-being.

What are some things to consider when choosing a supplemental health insurance plan?

When choosing a supplemental health insurance plan there are a few things to consider. First, you will want to make sure that the plan you choose covers the types of care that you are likely to need. For example, if you have a chronic condition, you will want to make sure that your plan covers the cost of treatment for this condition. Second, you will want to consider how much coverage you need. You don’t want to pay for more coverage than you need, but you also don’t want to be under-insured. Finally, you will want to consider the cost of the plan. While it is important to find a plan that fits your budget, it is also important to make sure that the plan offers quality coverage.

What are some common types of supplemental health insurance plans?

There are a variety of different types of supplemental health insurance plans available. Some common types of plans include Medicare supplement plans, long-term care insurance plans, and cancer insurance plans.