Seguro Medico Assist Card – The Best Way to Save on Medical Expenses

Contents

- What is Assist Card?

- How does Assist Card work?

- What are the benefits of using Assist Card?

- How can I use Assist Card to save on medical expenses?

- What are some tips for using Assist Card?

- How do I know if Assist Card is right for me?

- What are the drawbacks of using Assist Card?

- Is Assist Card worth it?

- How do I sign up for Assist Card?

- What else do I need to know about Assist Card?

Looking for a way to save on medical expenses? Seguro Medico Assist Card is the best way to do it! With our card, you can get discounts on medical services and products all over the country.

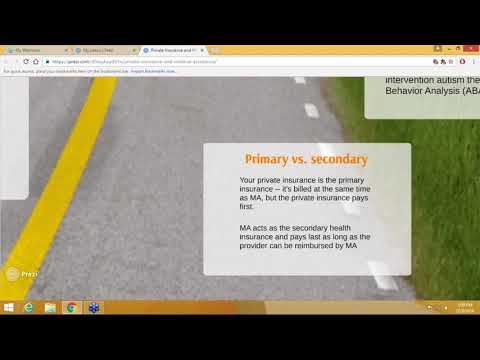

Checkout this video:

What is Assist Card?

Assist Card is a medical assistance and concierge service that helps you save money on medical expenses With Assist Card, you can get discounts on hospital stays, doctor visits, prescription drugs, and more. You can also get access to 24/7 customer support and a network of over 1 million doctors worldwide.

How does Assist Card work?

Seguro Medico Assist Card is a medical expense assistance program that helps members save on out-of-pocket medical expenses. The program is available to residents of Puerto Rico who are ages 21 and older and have an active hospitalization insurance policy. Members can use their Assist Card at any participating hospital or medical facility in Puerto Rico. When you use your Assist Card, you will receive a discount on your medical expenses.

What are the benefits of using Assist Card?

Seguro Medico Assist Card is a card that gives you discounts on medical expenses. When you use the card, you will save money on your medical bills The card can be used for both inpatient and outpatient care. You can also use it for emergency care.

How can I use Assist Card to save on medical expenses?

Assist Card is a medical insurance card that can save you money on medical expenses. The card is accepted by most major hospitals and clinics in the United States and can be used to discounts on prescription medications, lab tests, and other medical services.

What are some tips for using Assist Card?

Assist Card is a personal care/medical expense card that can be used to save on out-of-pocket medical expenses. The card can be used for any type of medical service, including doctors’ visits, hospital stays, prescriptions, and more. There are no restrictions on how the card can be used, and it can be used at any medical provider that accepts credit cards.

Here are some tips for using Assist Card:

* When making a purchase, always ask the medical provider if they accept Assist Card. Some providers may not be familiar with the card, so it’s important to ask in advance.

* Be sure to keep track of your spending. The card can be used at any time, but it’s important to know how much you’re spending so you don’t get overwhelmed with expenses.

* Use the card for all eligible medical expenses. The more you use the card, the more you’ll save on out-of-pocket costs.

* Check with your insurance provider to see if they offer a discount for using Assist Card. Some insurers offer a percentage off of your total bill if you use the card.

How do I know if Assist Card is right for me?

Assist Card is a great way to save on medical expenses, but it’s not right for everyone. Here are some things to consider when deciding if Assist Card is right for you:

-Do you have a regular doctor that you see? If so, Assist Card may not be right for you, as it only covers emergency medical expenses.

-Do you have health insurance? If so, you may not need Assist Card, as it only covers expenses that are not covered by insurance.

-Do you travel often? If so, Assist Card may be a good option for you, as it covers medical expenses incurred while traveling.

What are the drawbacks of using Assist Card?

There are a few potential drawbacks to using Assist Card that you should be aware of before signing up. First, the network of providers that Assist Card partners with may be limited in your area, which could make it difficult to find a participating doctor or hospital. Additionally, Assist Card only covers medical expenses related to accidental injury or illness – it does not cover routine care or preventive services. Finally, while Assist Card can help you save on medical expenses, it will not cover the entire cost of your medical bills you will still be responsible for paying a portion of the bill (usually 20-30%).

Is Assist Card worth it?

If you’re looking for a way to save on medical expenses, Seguro Medico Assist Card is definitely worth considering. With Seguro Medico Assist Card, you’ll get access to a network of doctors and facilities that offer discounts on medical services. Plus, you’ll also get assistance with things like prescriptions and lab work. Overall, Seguro Medico Assist Card is a great option for anyone who wants to save on medical costs.

How do I sign up for Assist Card?

Assuming you are based in the United States, signing up for Assist Card is a very straightforward process. You can visit the Seguro Medico website and click on the “Get a Quote” button. From there, you will be directed to a page where you can enter your zip code and choose your preferred plan.

What else do I need to know about Assist Card?

Assist Card is the world’s leading provider of global assistance and concierge services. We are available to our members 24 hours a day, 365 days a year. We have a network of providers and assistants who are ready to help you with anything you need, whether it’s finding a doctor or making travel arrangements.

We know that life can be unpredictable, and we are here to help you through the tough times. Whether you need assistance with a medical emergency, a lost passport, or even just some advice, we are here for you.

What else do I need to know about Assist Card?

-We offer a wide range of services to our members, including Medical Assistance concierge services, 24/7 support, and more.

-We have a network of providers and assistants who are ready to help you with anything you need.

-We are committed to providing the highest level of service possible to our members.