Minnesota Medical Assistance Estate Recovery

Contents [show]

Learn about Minnesota’s medical assistance Estate Recovery program and how it may affect your estate.

Checkout this video:

What is Medical Assistance estate recovery?

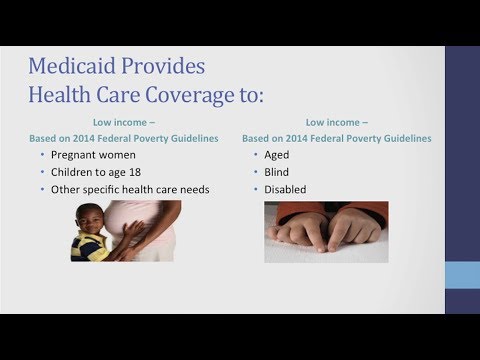

Minnesota medical assistance (MA) pays for health care services on behalf of some low-income and disabled individuals. If you are 55 or older, MA may try to recover the cost of these services from your estate after you die.

This process is known as medical assistance estate recovery. Under state and federal law, MA can only recover certain types of assets, and only after following certain procedures.

MA can only recover the cost of long-term care services that were paid for by MA. This includes nursing home care home care services, and other long-term care services. MA cannot recover the cost of other types of health care services, such as hospitalizations or doctor’s visits.

MA can only recover assets that are owned by the person who received MA benefits at the time of their death. This means that MA cannot recover assets that were given away or sold before the person’s death.

What does medical assistance estate recovery mean for Minnesota residents?

Medical assistance estate recovery means that, upon your death, the state of Minnesota may seek reimbursement from your estate for the cost of medical assistance (also known as Medicaid) that you received while alive. This includes long-term care services such as nursing home care

Minnesota’s medical assistance estate recovery program is authorized by federal and state law and is necessary to help ensure that the limited Medicaid program funds are available to those who need them most. The program helps to ensure that people do not take advantage of Medicaid by receiving long-term care services and then leaving their estate to their heirs without having to repay the state for the cost of those services.

Under Minnesota law, the value of your home is exempt from recovery if:

-You are survived by a spouse or by a child who is under 21 years of age or who is blind or disabled; OR

-Your home was held in a trust established before August 1, 1989; OR

-Your home was subject to a mortgage or other lien on August 1, 1989 (the date when the current law went into effect), and that mortgage or lien has not been fully paid off.

What assets are subject to medical assistance estate recovery in Minnesota?

After someone on medical assistance dies, the state of Minnesota may recover some of the medical assistance paid out for that person from their estate. This is called medical assistance estate recovery. The Department of Human Services (DHS) is required by federal and state law to pursue estate recovery for long-term care costs incurred by persons 55 years of age or older. DHS may also pursue estate recovery for persons of any age who were receiving disabled adult children’s (DAC) waiver services, or Alternative Care (AC) waiver services when they died.

Estate recovery only applies to certain assets. It does not apply to a person’s house, car, personal belongings, or life insurance policy with a face value of $5,000 or less.

The following assets are subject to medical assistance estate recovery in Minnesota:

-Real property, such as land or a house

-Individual retirement accounts (IRAs) and other retirement plans

-Annuities

-Cash value in life insurance policies with a face value greater than $5,000

How does medical assistance estate recovery work in Minnesota?

In Minnesota, medical assistance estate recovery is the process by which the Minnesota Department of Human Services (DHS) recovers payment for medical assistance (MA) benefits paid on behalf of a deceased MA recipient from the recipient’s estate.

DHS may seek reimbursement for MA benefits paid for nursing facility care, home care, and other long-term care services from the estates of deceased MA recipients who were 55 years of age or older at the time they received those services. DHS does not seek reimbursement from the estates of deceased MA recipients who were 54 years of age or younger at the time they received long-term care services.

Medical assistance estate recovery is a voluntary program. A person’s estate is not required to participate in medical assistance estate recovery.

What are the consequences of medical assistance estate recovery in Minnesota?

Estate recovery is the process whereby the State of Minnesota seeks reimbursement from the estate of a deceased medical assistance recipient for medical assistance paid on behalf of the recipient. The state may only seek reimbursement from the estates of individuals who were 55 years of age or older at the time they received medical assistance.

There are a few exceptions to this rule. The state will not seek reimbursement from the estate of a surviving spouse, a child who is under 21 years of age, a child who is blind or permanently disabled, or a disabled adult child.

If you have questions about whether or not your estate will be subject to medical assistance estate recovery, you should contact an experienced elder law attorney for help.

How can Minnesota residents avoid medical assistance estate recovery?

There are a few ways that Minnesota residents can avoid medical assistance estate recovery. One way is to spend down their assets so that they are below the medical assistance threshold. Another way is to transfer their assets to a family member or close friend. Finally, residents can create a trust fund that will shield their assets from estate recovery.

What are some common misconceptions about medical assistance estate recovery?

There are many common misconceptions about medical assistance estate recovery. One misconception is thatmedical assistance will take your home if you die. This is not true. Medical assistance only recovers assets from an estate after the person’s death if they were 55 or older when they received medical assistance, and their estate includes a home that was their primary residence at the time of their death.

Another common misconception is that medical assistance will take all of your assets if you die. This is also not true. Medical assistance only recovers assets from an estate after the person’s death if they were 55 or older when they received medical assistance, and their estate includes assets totaling more than $5,000.

A third common misconception is that medical assistance will take your entire estate if you have any outstanding medical bills when you die. This is not true either. Medical assistance only recovers assets from an estate to repay outstanding medical bills after the person’s death if they were 55 or older when they received medical assistance, and their estate includes assets totaling more than $5,000.

What happens if a Minnesota resident dies without paying back medical assistance?

Estate recovery is the legal process that allows the state of Minnesota to recoup money from the estates of deceased medical assistance recipients who were 55 years of age or older when they received medical assistance. The state can recover money for medical assistance paid on behalf of a deceased recipient from:

-The recipient’s estate

-A different individual responsible for the estate, such as an executor or administrator

-Jointly owned property

-A life insurance policy with the state listed as a beneficiary

How can Minnesota residents appeal medical assistance estate recovery?

In order to appeal medical assistance estate recovery in the state of Minnesota, one must fill out and submit an “Estate Recovery Appellate Request” form. This form is available on the Minnesota Department of Human Services website. The form must be submitted within 30 days of the date on the “Estate Recovery Notice.”

Where can Minnesota residents get more information about medical assistance estate recovery?

Minnesota residents can get more information about medical assistance estate recovery by visiting the Minnesota Department of Human Services website or by calling the Department’s medical assistance estate recovery hotline at 1-800-657-3739.