How to Calculate Annual Premium Health Insurance?

Contents

- Introduction

- What is Annual Premium Health Insurance?

- How to Calculate Annual Premium Health Insurance?

- Step One: Know the Base Rate

- Step Two: Determine the Age Factors

- Step Three: Consider the Gender Factors

- Step Four: Factor in the Health Status

- Step Five: Location Matters

- Step Six: Tobacco Usage

- Conclusion

This blog will show you how to calculate your annual premium for health insurance

Checkout this video:

Introduction

As you shop for health insurance you will see three different types of plans:

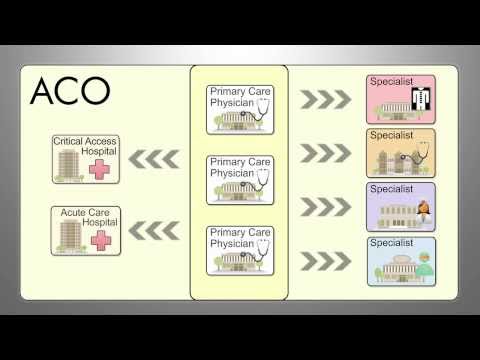

-Medical plans that include only doctors and hospitals within the plan’s network.

-Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), which are networks of doctors and hospitals that have agreed to provide care at a discount to people who have insurance through the plan.

-High Deductible Health Plans (HDHPs), which have lower monthly premiums but higher deductibles.

You will also see four different ways to pay for your health insurance

-Premiums, which are the monthly payments you make to your insurance company.

-Co-payments, which are the fixed amounts you pay for specific services, such as doctor visits or prescriptions.

-Co-insurance, which is the percentage of covered expenses you pay after you have met your deductible.

-Deductibles, which are the amounts you must pay for covered services before your insurer begins to pay.

To calculate your annual premium, you will need to know:

-The type of plan you want.

-The network of doctors and hospitals you want to be covered by.

-How much you are willing to pay in monthly premiums.

-How much you are willing to pay in out-of-pocket costs, such as deductibles and co-payments.

What is Annual Premium Health Insurance?

An annual premium is the amount of money you pay each year for your health insurance policy. Your premium pays for the coverage you receive under your health insurance policy. The amount of your premium may vary depending on your age, the type of health insurance policy you have, and the amount of coverage you need.

How to Calculate Annual Premium Health Insurance?

It is very important for you to know how to calculate annual premium health insurance so that you can be sure that you are getting the best possible rate for your health insurance coverage. There are a few factors that you will need to take into consideration when you are trying to calculate your annual premium, such as the type of coverage that you have, the deductible that you have chosen, and the co-payment that you have agreed to.

Step One: Know the Base Rate

In order to calculate your annual premium for health insurance, you will need to know the base rate. The base rate is the starting price for your health insurance policy. This rate is typically determined by your age, gender, and health status. While these factors will vary from one insurance company to another, they are generally standardized across the industry.

In order to get an accurate base rate, it is important that you provide accurate information to your insurance company. If you do not, you may be charged a higher rate than you should be.

Step Two: Determine the Age Factors

Now that you know your base rate per $1,000 of coverage, you need to determine the age factor. This is based on the age of the oldest person who will be covered under the policy. The older someone is, the more likely he or she is to have a health condition that will require medical care. Therefore, the older someone is, the higher his or her premiums will be.

For example, let’s say the oldest person on your policy is 40 years old. Using the age factor chart below, you would multiply your base rate per $1,000 of coverage by 1.14 to get your final rate per $1,000 of coverage.

Age Factor Chart:

Age Factor

0-20 1.00

21-30 1.03

31-40 1.14

41-50 1.29

51-60 1.48

61-70 1.71

71+ 2.00

Step Three: Consider the Gender Factors

Now that you know your health insurance rate, you need to consider the gender factors. If you are a man, you will be charged more for your health insurance than a woman. This is because men are more likely to get sick and use more medical services than women. In order to get the best deal on your health insurance, you should compare rates from different companies.

Step Four: Factor in the Health Status

After you have compiled a list of the potential health insurance companies that you want to research, you will need to find out what their rates are and how those rates are determined. Rates are usually determined by five factors:

-Tobacco use

-Age

-Family size

-Geographic location

-The chosen deductible and out-of-pocket maximum

Step Five: Location Matters

insurance companies will charge more or less for premiums depending on the state that you live in. For example, if you live in Florida, your health insurance premiums will be lower than if you lived in Alaska. The reason for this is that the insurance company knows that people who live in Florida are more likely to visit the doctor regularly because of the hot weather, while people who live in Alaska are less likely to do so because of the cold.

Step Six: Tobacco Usage

Tobacco usage is one of the factors that will be considered when applying for health insurance, and it can have a significant impact on the cost of your premium. If you use tobacco, you may be charged a higher premium, or you may be denied coverage altogether.

Conclusion

Now that you know how to calculate annual premium health insurance, you can make an informed decision about which policy is right for you. Remember, the premium is just one factor to consider when comparing health insurance policies. You also need to take into account the deductibles, copayments, and out-of-pocket maximums. By considering all of these factors, you can choose the policy that provides the best coverage at the best price.