How to Buy Supplemental Health Insurance?

Contents

Many people are confused about how to buy supplemental health insurance. This type of insurance is not required by law, but it can be very beneficial.

Checkout this video:

Introduction

Supplemental health insurance is a type of insurance that helps cover certain medical expenses not covered by your regular health insurance. It can help pay for things like co-pays, deductibles, and additional services. There are many different types of supplemental health insurance, so it’s important to research the options and find the right one for you and your family. Here are some tips on how to buy supplemental health insurance:

1. Know what your regular health insurance covers. This is the first and most important step in finding supplemental coverage. Make a list of what your regular health insurer does not cover, such as co-pays, deductibles, or extra services.

2. Research the different types of supplemental health insurance. There are many different types of supplemental health insurance policies available, so it’s important to research the options and find the one that best meets your needs. Some common types of supplemental coverage include: cancer insurance, gap insurance, disability insurance, dental and vision Insurance.

3. Get quotes from multiple insurers. Once you know what type of coverage you need, contact several different insurers and get quotes for their policies. Be sure to compare apples to apples when getting quotes by ensuring that each policy covers the same amount and type of expense.

4. Choose the policy that best meets your needs. Be sure to read the fine print before making any decisions, and select the policy that offers the best coverage at the best price for you and your family

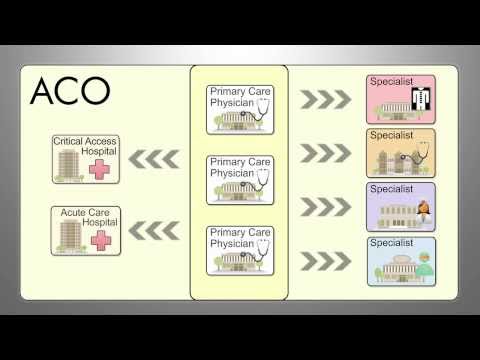

What is Supplemental Health Insurance?

Supplemental health insurance is a type of insurance that helps cover costs that your regular health insurance doesn’t. This can include things like out-of-pocket costs, Coinsurance, and deductibles. It’s a good idea to have supplemental health insurance if you have a high-deductible health plan. In this article, we’ll cover how to buy supplemental health insurance.

What Does Supplemental Health Insurance Cover?

Supplemental health insurance is a type of insurance that is designed to cover expenses that are not typically covered by a basic health insurance plan. It can help to fill in the gaps in your coverage and provide you with extra protection.

There are many different types of supplemental health insurance plans, and each one can cover different types of expenses. Some common types of expenses that are often covered by supplemental health insurance plans include:

-Dental care

-Vision care

-Prescription drugs

-Mental health care

-Substance abuse treatment

-Physical therapy

-Occupational therapy

Who Needs Supplemental Health Insurance?

Supplemental health insurance is a type of insurance that helps cover costs not covered by your regular health insurance plan. Many people opt for supplemental health insurance to help cover deductibles, copayments, and coinsurance. Some plans also provide coverage for things like prescription drugs, vision, and dental care.

Supplemental health insurance can be bought from a private insurer or through your employer. If you buy a plan through your employer, it may be bundled with your regular health insurance plan or offered as a separate voluntary plan.

There are many different types of supplemental health insurance plans available, so it’s important to do some research to find the best one for you. You should consider factors like coverage, costs, and whether the plan is offered through your employer.

Some people may not need supplemental health insurance because they already have good coverage from their regular health insurance plan. However, if you have high deductibles, copayments, or coinsurance, you may want to consider buying a supplemental plan to help pay for some of these costs.

How to Buy Supplemental Health Insurance

Supplemental health insurance is a type of insurance that helps to cover the costs of medical care that are not covered by your regular health insurance. It can help to cover things like co-pays, dental care, and vision care. supplemental health insurance is a good option for people who want to have some extra protection against unexpected medical bills.

Do Your Research

There are many different types of supplemental health insurance policies available, so it is important that you do your research before purchasing a policy. You should start by considering what types of coverage you need and then compare different policies to see which one will provide the best coverage for you at the most affordable price.

It is also important to make sure that you understand the terms and conditions of the policy before you purchase it. Be sure to read the fine print so that you know what is covered and what is not covered by the policy. You should also ask questions if there is anything that you do not understand about the policy.

Finally, be sure to shop around for the best price on supplemental health insurance. Different insurers offer different rates, so it is important to get quotes from several different companies before making a decision.

Consider Your Health and Budget

When you start shopping for a supplemental health insurance plan, you’ll need to have a few things in mind. First, think about your current health and any preexisting conditions you have. You’ll also want to consider your budget and what you can afford to pay in premiums each month.

Supplemental health insurance plans are designed to cover gaps in your existing health insurance coverage. They can help pay for things like copayments, coinsurance, and deductibles. Some plans may also cover expenses that your regular health insurance doesn’t, such as dental or vision care.

There are a few different types of supplemental health insurance plans to choose from, so it’s important to compare your options before you buy. Some plans may offer more coverage than others, so be sure to read the fine print before you make a decision.

Supplemental health insurance plans are not right for everyone, so it’s important to consider your needs before you purchase a policy. If you have questions about whether or not a supplemental plan is right for you, speak with a licensed agent who can help you make an informed decision.

Compare Plans and Prices

There are a number of ways to buy supplemental health insurance, but the simplest way is to compare plans and prices using an online comparison tool. This will allow you to see all of the available plans in your area and compare their features side-by-side.

When you’re comparing plans, be sure to pay attention to the following factors:

-The amount of coverage you need

-The deductibles and co-pays associated with each plan

-The provider networks for each plan

-The out-of-pocket maximums for each plan

-Any discounts or special offers that may be available

Once you’ve compared all of the relevant factors, you should be able to select the best supplemental health insurance plan for your needs.

Choose the Right Plan for You

Supplemental health insurance is designed to cover costs that your regular health insurance doesn’t, like deductibles, copays, and coinsurance.

There are many different types of supplemental health insurance plans available, and choosing the right one can be tricky. Here are a few things to keep in mind as you shop for a plan:

-What type of coverage do you need?

-What is your budget?

-What is the size of your deductible?

-What is the size of your coinsurance?

-How much coverage do you want?

Conclusion

Now that you know the basics of supplemental health insurance, you’re ready to start shopping for a policy. Be sure to compare different policies and prices before making a decision, and don’t hesitate to ask questions if you’re not sure about something. Once you find a policy that meets your needs, you can relax knowing that you and your family are covered in case of an unexpected health emergency.