How to Buy Health Insurance in Washington State

Contents [show]

If you’re a Washingtonian looking for health insurance you have a few different options. You can buy insurance through the state-run marketplace, directly from an insurance company, or through a broker. In this post, we’ll walk you through the process of buying health insurance in Washington State.

Checkout this video:

Introduction

Although health insurance is not mandatory in Washington state, it is still a good idea to have some form of coverage. There are many different health insurance plans available, and choosing the right one can be difficult. This guide will provide you with some basic information about health insurance in Washington state, and help you choose a plan that is right for you.

What to consider when buying health insurance in Washington State

There are many things to consider when buying health insurance in Washington State. The first is what type of coverage you need. The second is what type of plan you want. The third is how much you can afford to pay.

The type of plan you need

When you’re looking at health plans, you’ll need to decide which type of plan is right for you. The four main types of plans are Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), Point of Service (POS) plans, and High Deductible Health Plans (HDHPs).

Preferred Provider Organizations (PPOs)

A PPO plan gives you the flexibility to see any provider you’d like, but you’ll save money if you use a provider that is in the plan’s network. With a PPO plan, you don’t need to select a primary care physician (PCP).

-You can see any provider that is in-network without a referral.

-You can see an out-of-network provider, but it will cost you more.

-There is no limit on how much your insurance company will pay for out-of-network care.

Health Maintenance Organizations (HMOs)

An HMO plan requires you to see providers that are in the plan’s network. With an HMO plan, you must select a primary care physician (PCP) who will manage all of your medical care.

-You will need a referral from your PCP to see a specialist.

-You can only go out of network for emergency care.

-There is a limit on how much your insurance company will pay for out-of-network care.

Point of Service (POS) plans

A POS plan is a combination of an HMO and PPO plan. You must select a primary care physician (PCP), and you will need referrals to see specialists. You can also see providers outside of the network, but it will cost you more money.

-You can see any provider that is in-network without a referral from your PCP.

-You can see an out-of-network provider, but it costs more money and usually requires a referral from your PCP.

High Deductible Health Plans (HDHPs)

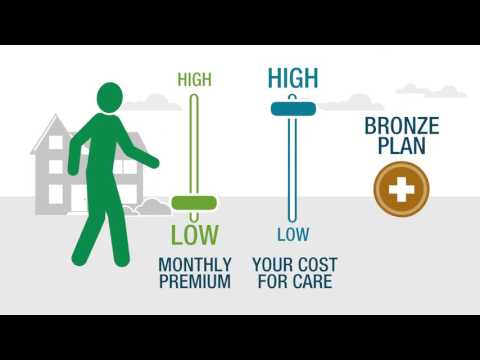

An HDHP has lower monthly premiums than other types of health plans, but higher deductibles. This means that you have to pay more out of pocket before your insurance coverage kicks in.

With an HDHP, you can open a Health Savings Account (HSA). An HSA is like a savings account, but the money in the account can be used to pay for qualifying medical expenses tax free!

The size of your deductible

Your deductible is the amount you pay for most of your medical care before your insurance company starts to pay. The size of your deductible will affect how much you pay for premiums and how much you pay when you get care.

If you choose a plan with a large deductible, you will have lower premiums but you will also have to pay more when you get care. If you choose a plan with a small deductible, you will have higher premiums but you will also pay less when you get care.

You can use this tool to help you compare plans and decide which one is right for you.

The first thing you should consider when buying health insurance is the size of your premium. This is the monthly amount you will have to pay for your health insurance coverage. The premium is based on a number of factors, including your age, gender, and health status. In general, the younger and healthier you are, the lower your premium will be. If you have a family, you will also have to pay a higher premium than if you were single.

Another factor that will affect the size of your premium is the type of health insurance plan you choose. There are three main types of health insurance plans:

-HMO (Health Maintenance Organization): An HMO plan typically has lower premiums than other types of plans, but it also has more restrictions. With an HMO plan, you must choose a primary care physician from a list of approved doctors, and you can only see specialists if they refer you.

-PPO (Preferred Provider Organization): A PPO plan has higher premiums than an HMO plan, but it also has more flexibility. With a PPO plan, you can see any doctor that accepts your insurance, and you don’t need a referral to see a specialist.

-POS (Point-of-Service): A POS plan is somewhere in between an HMO and a PPO in terms of premiums and flexibility. With a POS plan, you have a network of doctors to choose from, but you can also see out-of-network doctors for an additional cost.

Once you’ve considered all of these factors, you can start shopping around for health insurance quotes. You can get quotes from different insurers online or by talking to an insurance agent. When comparing quotes, be sure to compare apples to apples by looking at plans with the same coverage levels.

The network of providers

Before you choose a plan, make sure to check that your preferred providers are in the plan’s network. You can do this by going to the plan’s website or calling the plan directly. If you need help, contact the Customer Support Center at 1-800-769-7391 (TRS: 711).

It’s also important to make sure that the providers you want to see are taking new patients. Some providers may be “closed” to new patients, which means they are not accepting any new patients at this time.

How to buy health insurance in Washington State

Health insurance is a vital part of ensuring that you and your family are protected in case of an unexpected illness or injury. There are many different health insurance plans available, and it can be difficult to know which one is right for you. In this guide, we will walk you through the process of buying health insurance in Washington State.

Online

If you’re looking for health insurance, the first place to start is the Health Care Exchange at www.wahealthplanfinder.org. The Exchange is a one-stop shop where you can compare plans, get help with paying for coverage, and enroll in a plan. You can also find out if you qualify for a subsidy to help pay your premiums, or for free or low-cost coverage through Medicaid.

If you’re not sure where to start, you can use the “Get Help Now” feature on the Exchange website to find local in-person help, or call the customer support line at 1-855-923-4633.

In person

One way to buy health insurance in Washington State is to do so in person. If you live in the Seattle area, you can visit the offices of the Washington Health Benefit Exchange. There, you can speak with certified brokers who can help you choose a plan that meets your needs and budget. You can also shop for plans and compare prices online at the exchange website.

If you live outside of the Seattle area, you can still visit the Washington Health Benefit Exchange website to shop for plans and compare prices. You can also contact the customer service center by phone or email to get help with your search.

Another option for buying health insurance in person is to work with an independent insurance broker. These professionals are not affiliated with any one insurance company, so they can help you compare plans from multiple carriers. They may also be able to help you get discounts on your premiums if you qualify for certain programs.

By phone

You can shop for and compare plans, get quotes, and learn more about health insurance by calling the Washington State Health Insurance Marketplace at 1-855-923-4633.

When you call, you’ll be connected with a customer service representative who can answer your questions and help you find the right plan for you and your family.

Conclusion

After reading this guide, you should now have a good understanding of the different types of health insurance available in Washington State, as well as the factors you need to consider when choosing a plan.

There are many resources available to help you make your decision, including the Washington State Office of the Insurance Commissioner, which offers an online tool to compare different health insurance plans.

When you are ready to purchase health insurance, remember to shop around and compare rates from different companies before making your final decision.