How to Apply for Financial Assistance for Medical Bills

Contents [show]

Learn how to apply for financial assistance for medical bills by following these best practices.

Checkout this video:

Introduction

No one should have to choose between paying for their basic needs and getting the medical care they need. Unfortunately, faced with expensive medical bills, many people have to make that choice. If you or someone you know is struggling to pay for medical care, there are a few options for financial assistance. This guide will introduce you to some of the most common programs and explain how to apply for them.

##Heading: Medicaid

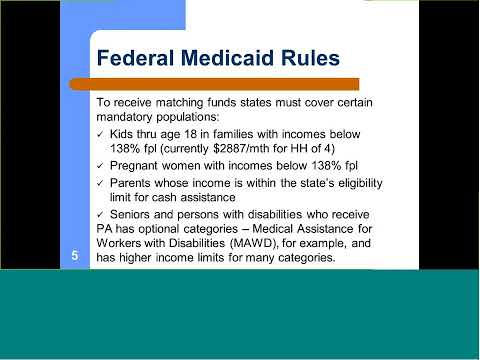

##Expansion: Medicaid is a government health insurance program that provides free or low-cost coverage to eligible low-income adults, children, pregnant women, people with disabilities, and the elderly. To be eligible for Medicaid, you must meet certain income and resource requirements.

In order to apply for Medicaid, you will need to fill out an application and submit it to your state’s Medicaid office. You can find your state’s office through the website of the Centers for Medicare and Medicaid Services (CMS). The application process can vary from state to state, so it is important to follow your state’s specific instructions.

You can find more information about Medicaid and how to apply on the CMS website or through your state’s Medicaid office.

##Heading: Medicare

##Keywords: hospital insurance, Medical Insurance, Premiums Keywords:, deductibles,, Coinsurance copayments Expansion:Medicare is a government health insurance program that provides coverage to eligible people who are 65 years of age or older, certain younger people with disabilities, and people with end-stage renal disease (ESRD). There are four parts to Medicare: hospital insurance (Part A), medical insurance (Part B), Medicare Advantage Plans (Part C), and prescription drug coverage (Part D).

Most people who are eligible for Medicare Part A (hospital insurance) do not have to pay a premium for this coverage. If you are eligible for Part B (medical insurance), you will have to pay a monthly premium that is deducted from your Social Security benefits or billed directly to you. There are also deductibles, coinsurance, and copayments associated with Part B coverage.

If you would like more comprehensive coverage than what Parts A and B offer, you may be interested in signing up for a Medicare Advantage Plan (Part C). These plans are offered by private companies that contract with Medicare. You will still have to pay your Part B premium as well as any premiums charged by the private company offering the Advantage Plan. While each plan has its own rules about what services are covered and how much you will have to pay out-of-pocket when you receive them, all Plans must provide at least the same level of coverage as Original Medicare Parts A and B.

Finally, if you need helppaying for prescription drugs costs, you can sign upfor Part D prescription drug coverage through a private company that contracts with Medicare. You will likely haveto pay a monthly premium for this coverage as well as any deductibleand coinsurance costs when you receive prescriptions filled.

wanting more information about how Parts A-D work together or howto enroll in one or more of these programs To get started,. please visitMedicare’s website Or contact1-800-MEDICARE(1-800-633-4227).

What is Financial Assistance for Medical Bills?

Financial assistance for medical bills is a process where you can request help from the hospital or other medical provider to pay your bill. This type of assistance is usually need-based, which means that the hospital or provider will look at your income and assets to determine if you qualify.

There are a few different ways that you can request financial assistance for medical bills. The first way is to fill out a Financial Assistance Application form. This form is usually available on the hospital or provider’s website. Once you have completed the form, you will need to submit it along with supporting documentation, such as proof of income and assets.

The second way to request financial assistance for medical bills is to contact the hospital or provider directly and ask about their policy. Each hospital or provider has different guidelines for who qualifies for financial assistance, so it’s important to find out this information before you submit an application.

Once you have submitted an application for financial assistance, the hospital or provider will review your situation and make a decision about whether or not they can help you. If they decide that they can assist you, they will typically contact you to let you know what steps to take next. If they are unable to help you, they may still be able to offer advice on other options that may be available to you.

Who is Eligible for Financial Assistance for Medical Bills?

There are a number of financial assistance programs available for medical bills, but not all of them are available to everyone. Some programs are only available to low-income individuals or families, while others may have stricter eligibility requirements.

Here are some of the most common programs that offer financial assistance for medical bills:

-Medicaid: Medicaid is a government-funded health insurance program that is available to low-income individuals and families. Each state has its own eligibility requirements, but in general, you must be a US citizen or legal resident and have a low income in order to qualify.

-Children’s health insurance Program (CHIP): CHIP is a government-funded health insurance program that is available to children who do not qualify for Medicaid. Each state has its own eligibility requirements, but in general, you must be a US citizen or legal resident and have a low income in order to qualify.

–health care FSA (Flexible Spending Account): A Health Care FSA is a type of account that allows you to set aside pre-tax money to be used for qualified medical expenses. Not everyone is eligible for a Health Care FSA, as it is only offered through certain employers. However, if you are eligible, you can use the funds in your account to pay for medical bills that are not covered by insurance.

How to Apply for Financial Assistance for Medical Bills?

There are a few ways that you can apply for financial assistance for medical bills. The best way to start is by contacting your local hospital or medical facility and asking about their financial assistance policies. You can also contact your insurance company or the government’s Health Resources and Services Administration (HRSA) to see if you qualify for any programs that could help with your medical bills. Finally, consider crowd-funding your medical expenses through a site like GoFundMe or YouCaring.

What is the Process for Applying for Financial Assistance for Medical Bills?

There are many ways to get help paying for medical bills, but the process can be confusing and overwhelming. Financial assistance is available from a variety of sources, including hospitals, charities, and government programs. But how do you know where to start?

The first step is to contact your hospital’s financial assistance office and explain your situation. They will be able to tell you what assistance may be available and how to apply. You may also be able to find information on the hospital’s website.

If you don’t qualify for assistance from the hospital, there are other options to explore. Charities and non-profit organizations may offer help with medical bills, for example. You can search for these organizations online or in your local community.

Government programs may also offer assistance with medical bills. Medicaid is one example of a program that can help low-income individuals and families pay for health care costs. To learn more about Medicaid, contact your state’s Medicaid office or visit the Centers for Medicare & Medicaid Services website.

Applying for financial assistance can be a time-consuming process, but it’s important to explore all your options if you’re struggling to pay your medical bills.

What Documentation is Required for Financial Assistance for Medical Bills?

If you are struggling to pay your medical bills, you may be wondering if you qualify for financial assistance. Many hospitals and other medical facilities offer financial assistance programs to help patients who are unable to pay their bill in full. However, each program has different requirements for eligibility. In this article, we will outline what documentation is typically required in order to apply for financial assistance for medical bills.

In order to apply for financial assistance, you will need to fill out an application form and provide supporting documentation. The specific documentation required will vary depending on the program, but it is typically going to include proof of income, assets, and expenses. You may also be asked to provide documentation of your medical expenses. Once you have gathered all of the required documentation, you will need to submit it along with your application form.

It is important to note that each financial assistance program has different eligibility requirements. Be sure to check with the specific program that you are interested in before gathering your documentation. This way, you can be sure that you are meeting all of the requirements and increase your chances of being approved for assistance.

How is the Decision Made on Financial Assistance for Medical Bills?

There is no one definitive answer to how financial assistance for medical bills is decided. Different organizations will have different criteria and levels of assistance. Some may base their decisions purely on income, while others may also consider factors such as medical need or extenuating circumstances.

What are the Appeals Process for Financial Assistance for Medical Bills?

If you have been denied financial assistance for medical bills, you may be able to appeal the decision. The appeals process can be confusing and overwhelming, but it is important to understand your rights and how to navigate the system.

There are two types of appeals: informal and formal. An informal appeal is a request for reconsideration of your case by the financial assistance office. This type of appeal is usually made in writing and does not require a hearing. A formal appeal, on the other hand, is a request for a hearing with an impartial panel. This type of appeal is more serious and should only be used if you feel confident that you have a strong case.

The first step in either type of appeal is to contact the financial assistance office to find out why you were denied. Once you have this information, you can begin to build your case. It is important to remember that the burden of proof is on you to show that you deserve financial assistance.

If you decide to file an informal appeal, it is important to be polite and professional in all communications with the financial assistance office. Be sure to follow up after sending any correspondence and keep copies of everything for your records.

If you decide to file a formal appeal, you will need to fill out an application and submit it to the office along with any supporting documentation. Once your application has been received, you will be notified of the date, time, and location of your hearing. At the hearing, both sides will present their case before the panel and answer any questions from the panelists. After hearing both sides, the panel will make a decision about whether or not to grant financial assistance.

What are the Alternatives to Financial Assistance for Medical Bills?

There are several ways to get help with medical bills, but it’s important to understand all your options before making a decision. Depending on your situation, you may be able to negotiate with your medical provider, use a credit card, take out a personal loan, or look into government assistance programs.

Some medical providers are willing to offer discounts for upfront payment or if you set up a payment plan. If you have good credit, you may be able to get a low-interest rate on a credit card or personal loan. Government assistance programs like Medicaid and CHIP can help cover the cost of medical care for those who qualify.

It’s important to compare all your options carefully before making a decision. Consider factors like interest rates, fees, and repayment terms when comparing financial products. And make sure you understand all the terms and conditions before agree to anything.

Conclusion

In conclusion, financial assistance for medical bills is available for those who qualify. The application process can be long and complicated, but it is worth it to get the help you need. Be sure to gather all of the required documentation and to complete the application in full.