Health Insurance for the Elderly: What You Need to Know

Contents [show]

There are a lot of health insurance options out there, and it can be tough to know which one is right for you. If you’re over the age of 65, you’ll want to make sure you have a good understanding of Medicare and what it covers. In this blog post, we’ll go over everything you need to know about health insurance for the elderly, so you can make the best decision for your needs.

Checkout this video:

The elderly and health insurance

There are a number of health insurance options available to seniors, and it can be difficult to understand all of the different coverage types and plan options. In this guide, we’ll provide an overview of some of the most common types of health insurance for seniors, as well as some tips on how to choose the best plan for your needs.

One of the first things to understand about health insurance for seniors is that there are a few different ways to obtain coverage. Seniors can purchase an individual health insurance policy, they can enroll in a Medicare Advantage plan, or they can sign up for a Medicare Supplement plan. There are also a number of government-sponsored health insurance programs available to low-income seniors, such as Medicaid.

When choosing a health insurance plan it’s important to consider your needs and budget. If you’re healthy and only need basic coverage, you might be able to get by with a less expensive plan. However, if you have chronic health conditions or anticipate needing more extensive coverage, you’ll want to choose a plan with more comprehensive benefits.

It’s also important to keep in mind that your health insurance needs may change as you age. For example, you might need more coverage for prescription drugs or long-term care as you get older. As such, it’s a good idea to review your coverage every year and make sure that it still meets your needs.

If you’re looking for health insurance for seniors, there are a number of resources available to help you compare plans and find the best option for your needs. The federal government’s HealthCare.gov website is a good place to start, as it offers information on Medicare and other government-sponsored health insurance programs. You can also contact your state’s Department of Insurance for assistance in finding plans available in your area.

The types of health insurance available for the elderly

There are a few different types of health insurance available for the elderly. The most common is Medicare, which is a government-sponsored health insurance program. Medicare covers hospitalization, doctors’ visits, and some prescription drugs. There are also some private health insurance plans that are available for seniors. These plans typically cover things like routine checkups, dental care, and vision care.

The benefits of having health insurance for the elderly

As you get older, your health insurance needs change. Medicare is a federal health insurance program for people 65 and over, as well as for those under 65 with certain disabilities. If you have other health coverage when you turn 65, you may be able to delay enrolling in Medicare without having to pay a penalty.

There are four parts to Medicare: hospital insurance (Part A), medical insurance (Part B), Medicare Advantage plans (Part C), and prescription drug coverage (Part D). You can enroll in all four parts, or just the ones that fit your needs.

Parts A and B are sometimes called “Original Medicare.” Part A covers inpatient hospital care, skilled nursing facility care, home health care, and hospice care. Part B covers outpatient services like doctor visits, preventive screenings, durable medical equipment, and some vaccines.

If you decide not to enroll in Parts A or B when you are first eligible, you may have to pay a late enrollment penalty if you later decide to enroll.

Parts C and D are offered by private insurance companies that contract with Medicare. Part C is also known as a “Medicare Advantage” plan. These plans must offer at least the same benefits as Parts A and B, but many plans offer additional benefits like routine dental, vision, and prescription drug coverage. Part D is prescription drug coverage offered by private insurance companies that contract with Medicare.

The benefits of having health insurance for the elderly are:

-You will have peace of mind knowing that you are covered in case of an accident or illness.

-You will have access to preventive care services that can help keep you healthy and catch problems early.

-You will have protection against high out-of-pocket costs for medical services.

-You will have the security of knowing that your coverage will not be cancelled if you get sick or have an accident.

The drawbacks of not having health insurance for the elderly

There are many potential drawbacks to not having health insurance for the elderly. One of the most significant is that without insurance, older Americans may be less likely to receive preventive care, which can lead to serious health problems down the road.

Another significant drawback is that without health insurance, seniors may be forced to pay for their own long-term care costs, which can be extremely expensive. In some cases, these costs can bankrupt an elderly person or their family.

Still another potential drawback of not having health insurance is that it may limit an elderly person’s ability to get the best possible medical treatment. This is because insurance companies often have contracts with certain hospitals and doctors that give them discounts on services. Without insurance, seniors may have to pay full price for their care, which can be very expensive.

How to choose the right health insurance for the elderly

Health insurance is a type of insurance that covers the cost of an individual’s medical and surgical expenses. It is an agreement between an individual and an insurance company, wherein the insurer agrees to pay the medical expenses as specified in the policy.

There are different types of health insurance plans available in the market, which can be customized as per the need of an individual. However, it is important to choose a plan that offers adequate coverage and fits within the budget.

Some of the factors that need to be considered while choosing a health insurance plan for the elderly are:

– The type of coverage required: Based on the health condition of the elderly person, it is important to choose a plan that offers comprehensive coverage. For example, if the person is suffering from any chronic illness, then it is advisable to opt for a plan with no coverage limit.

– The premium amount: It is important to compare the premium amounts charged by different insurers before finalizing a plan. The premium amount should be affordable and should not put burden on the finances.

– The network hospitals: Most of the health insurance plans have tie-ups with specific hospitals. It is important to check whether the hospitals included in the network are located near the residence of the elderly person. In case of any emergency, it would be convenient if the hospital is located nearby.

– Claim settlement ratio: It is advisable to choose an insurer with a good claim settlement ratio. This indicates that there are less chances of denial of claims by the insurer.

The costs of health insurance for the elderly

The costs of health insurance for the elderly can be quite high, especially if you are not covered by Medicare. Many private insurance companies offer health plans for seniors, but they can be expensive. Here are some things to keep in mind when shopping for health insurance for the elderly:

-Look for a policy with a good mix of coverage and cost. You want to make sure you are getting good value for your money.

-Make sure the policy covers the types of medical care you are likely to need. For example, if you have a chronic condition, you will want a policy that covers prescription drugs and doctor’s visits.

-If you are healthy and active, you may be able to get by with a less expensive policy that has a higher deductible. This means you will pay more out of pocket for medical expenses, but your monthly premiums will be lower.

-Talk to your family and doctor about your health insurance needs. They may have suggestions about which type of policy would be best for you.

The coverage of health insurance for the elderly

There is no one-size-fits-all answer to the question of how much health insurance coverage the elderly need. However, there are a few things to keep in mind when making your decision.

First, it’s important to know that Medicare does not cover long-term care. This means that if you or your spouse need nursing home care, you will have to pay for it out of pocket.

Secondly, even if you have private health insurance, your coverage may not extend to your spouse. This is because many private insurers consider marriage to be a pre-existing condition. as a result, they may refuse to cover your spouse or charge you higher premiums.

Finally, keep in mind that the cost of health care is rising rapidly. In addition to paying for health insurance premiums, you will also likely have to pay high deductibles and co-pays. As a result, it’s important to make sure that you have enough saved up to cover these costs if necessary.

How to make the most of health insurance for the elderly

There are a few things to keep in mind when it comes to health insurance for the elderly. First, it’s important to remember that Medicare does not cover long-term care. That means that if you or your spouse will need help with things like bathing, dressing, or eating in the future, you’ll need to plan for that financially.

Second, you should be aware that Medicare does not cover dental care or eyeglasses. If you think you’ll need dental work or new glasses, you should start saving now.

Third, if you decide to retire before you turn 65, you may not be eligible for Medicare. In that case, you’ll need to purchase a private health insurance policy. There are a number of different options available, so it’s important to do your research and find one that fits your needs and budget.

Finally, remember that your health insurance needs will change as you get older. You may need to purchase a supplemental insurance policy to cover things that Medicare doesn’t, such as long-term care or dental care. If your health changes and you become ineligible for Medicare, you may need to find a new health insurance policy altogether.

Making the most of health insurance for the elderly requires planning and research. But if you take the time to understand your options, you can find a policy that meets your needs and budget.

The importance of health insurance for the elderly

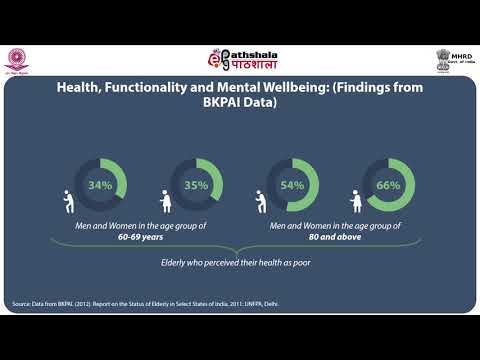

As people age, their health care needs change. They are more likely to experience chronic health conditions, such as heart disease, stroke, diabetes, cancer and arthritis. They also are more likely to need long-term care services and support.

The cost of health care for the elderly can be expensive. In 2018, the average cost of a hospital stay for Medicare beneficiaries was $5,220. The cost of nursing home care can also be high, averaging $7,441 per month for a private room and $6,235 per month for a semi-private room.

Medicare is the federal health insurance program for people 65 years of age and older. While Medicare does cover some of the costs associated with health care for the elderly, it does not cover all costs. For example, Medicare does not cover long-term care services or support.

Medicaid is a joint federal-state program that helps with medical costs for some people with limited income and resources. Medicaid also covers long-term care services and support for people who meet certain eligibility requirements.

To help cover the costs of health care not covered by Medicare or Medicaid, many people purchase private health insurance policies. These policies vary in what they cover and how much they cost. Some policies cover only hospital stays while others cover both hospital stays and doctor visits. It’s important to compare policies carefully to make sure you are getting the coverage you need at a price you can afford.

Health insurance for the elderly: FAQs

Q: What is health insurance?

A: Health insurance is a type of insurance that covers the cost of medical care.

Q: Why do I need health insurance?

A: Health insurance helps you pay for the cost of medical care, which can be expensive.

Q: How much does health insurance cost?

A: The cost of health insurance depends on many factors, such as your age, the type of coverage you need, and whether you have pre-existing conditions.

Q: How do I get health insurance?

A: You can get health insurance through your employer, from a private insurer, or from the government.

Q: What are some of the things that health insurance covers?

A: Health insurance can cover the cost of office visits, prescriptions, hospital stays, surgery, and more.