Government Assistance for COVID Medical Bills

Contents [show]

The government has announced a new program to help with medical bills related to COVID-19. If you have been impacted by the virus, learn more about this financial assistance and how to apply.

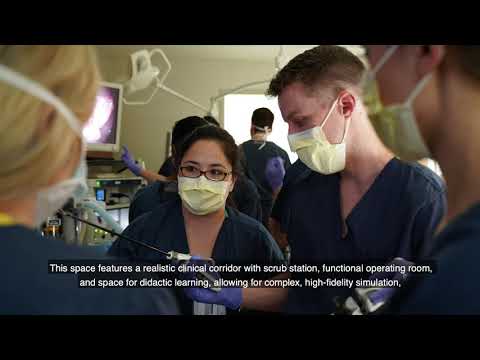

Checkout this video:

What government assistance is available for COVID medical bills?

There are a few programs offering government assistance for COVID medical bills. The first is the Coronavirus Relief Fund, which was established by the CARES Act. This fund provides reimbursement to states and local governments for expenses related to the COVID-19 pandemic. Eligible expenses include testing, personal protective equipment, and treatment of COVID-19 patients.

The second program is the Accelerated and Advance Payment Program, which is administered by the Centers for Medicare & Medicaid Services (CMS). This program provides advance payments to Medicare providers so they can keep treating patients during the pandemic.

The third program is the Provider Relief Fund, which was also established by the CARES Act. This fund provides financial assistance to healthcare providers impacted by the COVID-19 pandemic. Payments from this fund can be used for a variety of purposes, including lost revenue, increased costs, or other expenses related to COVID-19.

Finally, there is the Small Business Administration’s (SBA) Economic Injury Disaster Loan (EIDL) program. This program provides low-interest loans of up to $2 million to small businesses and non-profits that have been impacted by the pandemic. Loans can be used for a variety of purposes, including working capital, payroll expenses, and sick leave.

How can I apply for government assistance to help with my COVID medical bills?

There are a few different programs that can offer assistance with medical bills related to COVID-19. The first is the CARES Act, which provides for a refundable tax credit to help cover the cost of health insurance This credit is available to those who have lost their job or had their hours reduced due to the pandemic. The second program is the Federal Pandemic Unemployment Compensation program, which provides an additional $600 per week for those who are unemployed due to the pandemic. Finally, the Small Business Administration has a disaster loan program that can provide up to $2 million in low-interest loans to small businesses affected by the pandemic.

What are the eligibility requirements for government assistance with COVID medical bills?

Individuals who are eligible for government assistance with COVID medical bills must meet the following criteria:

-Be a U.S. citizen or legal resident

-Have a qualifying medical condition as determined by the Centers for Disease Control and Prevention (CDC)

– be unable to pay for COVID-related medical care out of pocket

– Meet income eligibility requirements

How much government assistance can I receive for my COVID medical bills?

The amount of government assistance you can receive for your COVID medical bills will depend on several factors, including your income level and the type of coverage you have. You may be eligible for financial assistance through programs like Medicaid or the Children’s health insurance Program (CHIP), or you may be able to get help from your state or local government. If you do not have insurance, you may still be able to get help with your medical bills through programs like the COVID-19 Financial Assistance Program from the federal government.

What is the process for applying for government assistance with COVID medical bills?

If you are unable to pay your medical bills related to COVID-19, you may be eligible for government assistance. The process for applying for assistance varies depending on your country of residence, but generally you will need to fill out an application and provide documentation of your medical expenses. Once your application is approved, you will be able to receive government assistance to help cover the cost of your medical bills.

How long does it take to receive government assistance for COVID medical bills?

It can take up to six weeks to receive government assistance for COVID medical bills, but you may be able to get help sooner if you need it. The government has set up a special program to help people with their medical bills related to COVID-19, and they are working as quickly as possible to get the money to those who need it. If you have questions about your specific situation, you can contact your local representative or the COVID assistance line for more information.

What are the tax implications of receiving government assistance for COVID medical bills?

There are a few different types of government assistance for COVID medical bills, and each has different tax implications.

The first type of assistance is through the CARES Act, which provides a refundable tax credit to those who have insurance and incur COVID-related expenses. The credit is worth up to $3,000 per person ($6,000 for families) and can be applied to any type of health insurance including Medicare, Medicaid, and private insurance.

The second type of assistance is through the Families First Coronavirus Response Act, which provides reimbursable tax credits to employers who provide paid sick leave or paid family and medical leave for COVID-related reasons. The credit is worth up to $511 per day for each employee on sick leave, or $200 per day for each employee on paid family and medical leave.

Lastly, the CARES Act also provides a deduction for any qualified medical expenses that exceed 7.5% of your Adjusted Gross Income (AGI). This includes any COVID-related medical expenses that are not covered by insurance.

What other government assistance programs are available to help with COVID medical bills?

There are other government assistance programs available to help with COVID medical bills. The Department of Health and Human Services (HHS) has several programs that may be able to help, including the Low Income Home Energy Assistance Program (LIHEAP), the Community Services Block Grant (CSBG), and the Emergency Food and Shelter Program (EFSP). You can find more information about these programs on the HHS website or by contacting your state or local social service office.

What are some tips for reducing my COVID medical bills?

There are a few things you can do to help reduce the cost of your COVID medical bills:

1. Check with your health insurance provider to see if they cover COVID-related treatment. Many insurance plans have waived co-pays and deductibles for COVID-19 treatment, so you may not be responsible for any out-of-pocket costs.

2. If you don’t have health insurance you may still be eligible for free or low-cost care through government assistance programs. The U.S. Department of Health and Human Services provides a list of resources that can help you find financial assistance for medical bills related to COVID-19.

3. If you’re able to pay your bill in full, some providers are offering discounts of up to 30% if you pay within 30 days. Be sure to inquire about this when you receive your bill.

4. Many providers are also offering extended payment plans that can help make your medical bills more manageable. Again, be sure to ask about this when you receive your bill.

How can I get help paying my COVID medical bills if I don’t qualify for government assistance?

If you don’t qualify for government assistance, there are still options for getting help paying your COVID medical bills. You can check with your state or local government to see if there are any programs available to help cover the cost of medical care. You can also contact your insurance company to see if they offer any type of financial assistance. Finally, you can also look into private charities or fundraising platforms that may be able to help you cover the cost of your medical bills.