Can You Add Elderly Parents to Your Health Insurance?

Contents

- Introduction

- What are the benefits of adding elderly parents to your health insurance?

- What are the drawbacks of adding elderly parents to your health insurance?

- How to add elderly parents to your health insurance

- How to find the right health insurance for your family

- What to do if your parents can’t afford health insurance

- The importance of health insurance for the elderly

- How to choose the best health insurance for your parents

- The difference between Medicare and Medicaid

- What to do if your parents are on Medicare or Medicaid

Many people are wondering if they can add their elderly parents to their health insurance plans. The answer may vary depending on the insurer, so it’s best to check with your provider.

Checkout this video:

Introduction

It’s a question many people ask as they approach retirement age: can you add elderly parents to your health insurance? The answer, unfortunately, is not always simple. It depends on a number of factors, including the type of insurance you have, the state in which you live, and your parents’ own health and financial situation.

If you have employer-sponsored health insurance you may be able to add your parents to your plan. This is typically allowed if your parents are over the age of 65 and are not eligible for Medicare. However, each employer has different rules about adding family members, so you’ll need to check with your human resources department to see if this is an option.

If you have an individual health insurance policy, you may also be able to add your parents. Again, this will depend on the rules of the particular insurer and the state in which you live. Some states have laws that require insurers to allow adult children to add their elderly parents to their policies. Other states don’t have such laws, so it’s up to the discretion of the insurer.

It’s also important to keep in mind that adding elderly parents to your health insurance policy will likely increase your premiums. This is because insurance companies consider older adults to be more high-risk than younger people and therefore charge higher rates for coverage. How much your rates will go up will depend on a number of factors, including the health of your parents and their expected use of medical services.

What are the benefits of adding elderly parents to your health insurance?

There are a few potential benefits of adding elderly parents to your health insurance coverage. First, if your parent is over the age of 65, they may be eligible for Medicare benefits. Adding them to your health insurance plan can help supplement their Medicare coverage. Additionally, if your parent is not yet eligible for Medicare, adding them to your health insurance can help ensure that they have access to quality health care coverage. In addition, depending on your health insurance plan, you may be able to get a family discount by adding additional members to your policy.

What are the drawbacks of adding elderly parents to your health insurance?

There are a few key things to keep in mind before adding your elderly parents to your health insurance plan. First, your premium will increase – sometimes by a lot. This is because insurance companies view older adults as higher-risk than younger ones. That being said, your parents will likely need more healthcare services as they age, so the increased premium may be worth it. Another thing to consider is that your parents’ health problems could lead to higher deductibles and copayments for you. If your parents have chronic conditions or take multiple medications, this could add up quickly. Finally, if you are close to reaching your insurer’s maximum out-of-pocket limit, adding your parents to your plan could cause you to exceed it and be responsible for 100% of their medical costs.

How to add elderly parents to your health insurance

You may be wondering how to add elderly parents to your health insurance. The good news is that there are a few ways to do this.

One way is to contact your insurance company directly and ask about adding an additional member to your plan. This option may be available if your parents are of retirement age and are not already covered by Medicare or another health insurance plan.

Another way to add elderly parents to your health insurance is to purchase a family health insurance policy. This type of policy typically covers two adults and dependent children under the age of 26. If your parents are over the age of 65, they may not be eligible for this type of coverage.

A third option for adding elderly parents to your health insurance is to enroll them in a Medicare Advantage Plan. This type of coverage is for people who are enrolled in Medicare Part A and Part B, which covers hospital and medical expenses, respectively. Medicare Advantage Plans offer additional benefits such as prescription drug coverage, vision and dental care, and more.

Adding elderly parents to your health insurance can be a great way to make sure they have the coverage they need in case of an emergency. Be sure to compare the different options available before making a decision so that you can find the best possible solution for your family.

How to find the right health insurance for your family

Adding an elderly parent to your health insurance plan can be a great way to help them with the costs of their medical care. However, it’s important to make sure that you’re getting the right type of coverage for your family’s needs. Here are some things to keep in mind when you’re looking for health insurance for your family:

– Make sure that the plan covers the types of care that your parent will need. Elderly parents often have different medical needs than younger family members, so it’s important to make sure that their needs will be covered by the plan.

– Consider the cost of the premium and the deductible. If you’re looking for a plan that will cover most of your parent’s medical costs, you’ll likely have to pay a higher premium. However, if you’re willing to pay more out-of-pocket costs, you may be able to find a plan with a lower premium.

– Check whether the plan has any age limits or other restrictions on coverage. Some plans only cover people up to a certain age, so it’s important to make sure that your parent will be eligible for coverage.

– Ask about any discounts that may be available. Many insurance companies offer discounts for families who buy their coverage through an employer or who have multiple members on the same plan.

What to do if your parents can’t afford health insurance

If your parent is retired or no longer employed, they may not have health insurance. This can be a major problem if they have a health condition that requires regular treatment or medication. Thankfully, there are a few options available to help your parents get the coverage they need.

One option is to add your parent to your health insurance plan. Most plans will allow you to do this, but it may come with an increased premium. Another option is to help your parent sign up for Medicare. This government-sponsored health insurance program is available to seniors and can help them cover the cost of their medical care.

If neither of these options is possible, don’t worry. There are still other ways to get your parent the coverage they need. You can contact their state’s Health Insurance Marketplace and see if they qualify for any subsidies or discounts. You can also look into private health insurance plans that may be available in your area.

No matter what option you choose, it’s important to make sure your parent has the health insurance coverage they need. With the right plan in place, they’ll be able to get the care and treatment they need without going broke in the process.

The importance of health insurance for the elderly

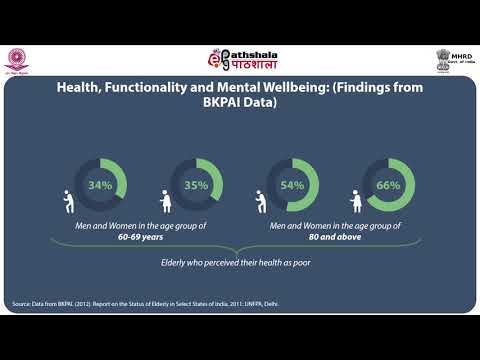

As people age, their health risks and needs change. This often means that their health insurance needs to change as well. For many people, this means adding elderly parents to their health insurance policy.

There are a few things to keep in mind when adding elderly parents to your health insurance policy. First, you will likely have to pay more for your coverage. This is because insurance companies consider older people to be a higher risk than younger people. Second, you may need to get a policy with a higher coverage limit. This is because older people tend to have more health issues than younger people. Finally, you may need to get a policy that covers more than just basic health care needs. This is because older people often need things like prescription drugs, vision care, and hearing aids.

If you are considering adding elderly parents to your health insurance policy, make sure to talk to your agent or insurer about your options. They can help you find the right policy for your needs and budget.

How to choose the best health insurance for your parents

As your parents age, their health needs are likely to change. They may require more medication, have more doctor’s appointments, or need to go to the hospital more often. All of these factors can impact the type of health insurance that they need.

There are a few things to consider when choosing health insurance for your parents. First, you need to decide whether you want to add them to your own policy or get them a separate policy. If you have a family plan, it may be cheaper to add them to your policy. However, if your parents have pre-existing conditions, they may be charged higher premiums or denied coverage altogether.

Another thing to consider is whether you want a policy that covers just basic needs or one that has more comprehensive coverage. Basic health insurance policies usually have lower premiums but higher deductibles. This means that your parents would be responsible for paying more out of pocket for their healthcare costs. A comprehensive policy would have higher premiums but would cover more of the costs associated with healthcare.

You should also think about where your parents live and whether they would need long-term care insurance. If they live in an area with high healthcare costs or if they have a chronic illness, long-term care insurance may be a good option. This type of policy can help cover the cost of nursing home care or in-home caregiving services.

Making the decision about how to insure your aging parents is not easy. However, if you take the time to research your options and compare different policies, you can find the best coverage for their needs at a price you can afford.

The difference between Medicare and Medicaid

There are two different types of government health insurance for seniors in the United States: Medicare and Medicaid. Both programs have different eligibility requirements and cover different health care expenses.

Medicare is a federal health insurance program for people 65 years of age or older, as well as for some younger people with disabilities. Medicare does not cover all medical expenses, so many seniors supplement their coverage with a private insurance policy.

Medicaid is a joint federal-state program that helps pay medical expenses for low-income people of all ages. Eligibility for Medicaid is based on income and assets, as well as on family size and composition. Each state has its own Medicaid program, so coverage and eligibility can vary from state to state.

What to do if your parents are on Medicare or Medicaid

If your parents are on Medicare or Medicaid, you may be wondering if you can add them to your health insurance. The answer is that it depends on the type of insurance you have. If you have a private health insurance plan, your parents will not be able to join your plan. However, if you have a family health insurance plan, your parents may be able to join your plan. You will need to contact your insurance company to see if they offer family health insurance plans and if your parents are eligible to join your plan.