Assisted Living in Longmont, Colorado: Medicaid Options

Contents

- What is Medicaid?

- How can Medicaid help with assisted living in Longmont, Colorado?

- What are the income and asset limits for Medicaid in Colorado?

- How do I apply for Medicaid in Colorado?

- What is the Medicaid spend down?

- How does the Medicaid estate recovery program work in Colorado?

- What are some common misconceptions about Medicaid?

- How can I get more information about Medicaid in Colorado?

- What are some other resources for assisted living in Longmont, Colorado?

- What are some tips for choosing an assisted living facility in Longmont, Colorado?

If you’re looking for assisted living in Longmont, Colorado, you’ll want to know about all your Medicaid options. This blog post covers everything you need to know to make the best decision for your loved one.

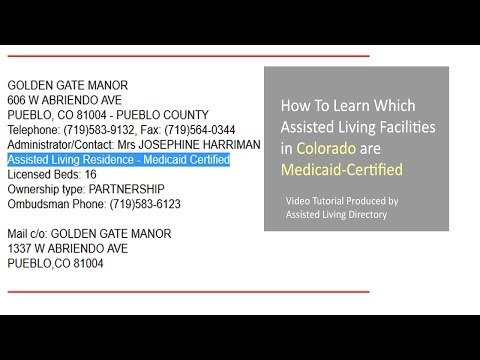

Checkout this video:

What is Medicaid?

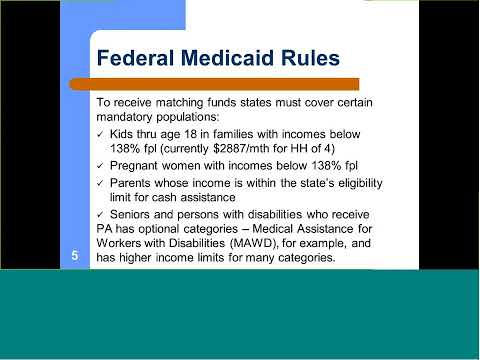

Medicaid is a government-funded health insurance program that provides coverage for low-income individuals and families. In Longmont, Colorado, Medicaid is administered by the Department of Health and Human Services (HHS).

Medicaid benefits can include doctor visits, hospital stays, prescription drugs, vision care, and more. Coverage is available for children, adults, seniors, and people with disabilities. To be eligible for Medicaid in Colorado, you must meet certain income and asset limits.

If you are eligible for Medicaid, you can enroll in one of the following health plans:

-Colorado Access

-Denver Health Medical Plan

-Humana Care Source

– Rocky Mountain Health Plans

How can Medicaid help with assisted living in Longmont, Colorado?

There are many ways that Medicaid can help with assisted living in Longmont, Colorado.

First, Medicaid can help pay for the cost of assisted living. This can be a great help for those who have a fixed income or who are on a tight budget.

Second, Medicaid can help with the cost of medications. Many people who live in assisted living facilities need help with their medication costs. Medicaid can help with this by covering some or all of the costs.

Third, Medicaid can help with the cost of transportation. Many people who live in assisted living facilities do not have their own transportation. Medicaid can help with this by providing transportation to and from doctor’s appointments and other activities.

Fourth, Medicaid can help with the cost of activities. Many people who live in assisted living facilities need help with the cost of activities. Medicaid can help with this by providing money for activities such as outings, entertainment, and field trips.

Finally, Medicaid can help with the cost of care. Many people who live in assisted living facilities need help with the cost of care. Medicaid can help with this by providing money for care services such as bathing, dressing, and eating.

What are the income and asset limits for Medicaid in Colorado?

To qualify for Medicaid in Colorado, you must have an annual income of less than $16,387 for an individual or $22,108 for a couple. You must also have less than $2,000 in countable assets.

How do I apply for Medicaid in Colorado?

If you or a loved one are interested in learning about how to apply for Medicaid in the state of Colorado, this article is for you. The process for applying for Medicaid in Colorado is relatively simple and can be completed online.

In order to complete the application process, you will need to gather some basic information about yourself and your finances. This includes your Social Security number, income information, asset information, and any other pertinent information that may be required. Once you have gathered all of the necessary information, you can begin the process of completing the application.

The first step in the process is to create an account with the Colorado Department of health care Policy and Financing. Once you have created an account, you will be able to log in and begin the process of completing the application. The next step is to provide some basic information about yourself and your family members who will be covered under the Medicaid program.

After you have provided all of the required information, you will be asked to submit documentation that supports your eligibility for Medicaid coverage. Once your application has been reviewed and approved, you will be notified of your eligibility and coverage start date.

What is the Medicaid spend down?

The Medicaid spend down is a way for people to qualify for Medicaid coverage of long-term care if they have too much income to otherwise qualify. Here’s how it works.

If your income is above the Medicaid eligibility limit, you can still qualify for coverage of long-term care costs if you’re willing to spend down your assets to below the limit. That is, you can use your own money to pay for some of your long-term care costs until you’ve reduced your assets to the point where you qualify for Medicaid.

For example, suppose you need $5,000 per month for long-term care, and you have $100,000 in assets. You could use $5,000 of your own money each month to pay for long-term care until your assets are reduced to $50,000. At that point, you would be eligible for Medicaid coverage of the remaining cost of your long-term care.

The Medicaid spend down only applies to the cost of long-term care, not other medical expenses. So, if you have $5,000 in monthly medical expenses and $100,000 in assets, you could not paying $5,000 out of pocket each month until your assets were reduced to $50,000 in order to become eligible for Medicaid coverage of the remaining medical expenses. You would only be able to use the Medicaid spend down to reduce yourassets enough to qualify for coverage of long-term care costs.

How does the Medicaid estate recovery program work in Colorado?

In Colorado, the Medicaid program is administered by the Department of Health Care Policy and Financing.

The Medicaid program pays for long-term care for eligible individuals. Medicaid also has an estate recovery program. The estate recovery program requires that, after an individual dies, Medicaid be reimbursed for the cost of long-term care services that were paid by Medicaid.

To be eligible for Medicaid coverage of long-term care services, an individual must meet certain financial and medical criteria.

An individual’s primary residence is exempt from estate recovery if:

-The spouse of the individual lives in the home; or

-A child of the individual who is under 21 years of age or who is blind or disabled (as defined by Social Security standards) lives in the home; or

-A sibling of the individual who has an equity interest in the home and who resided in the home for at least one year before the date on which the individual entered a long-term care facility lived in the home

What are some common misconceptions about Medicaid?

There are a few common misconceptions about Medicaid that we often hear here at our assisted living facility in Longmont, Colorado. First, people sometimes think that Medicaid is only for low-income individuals or families. This is not the case! Medicaid is actually a needs-based program, so anyone who meets the program’s eligibility criteria can qualify, regardless of income.

Second, we often hear people say that Medicaid only covers medical expenses. While it is true that Medicaid does cover most medical bills it also provides many other benefits, including long-term care services. In fact, Medicaid is the largest payer of long-term care services in the United States!

Finally, some people believe that they will never need to use Medicaid because they have private health insurance However, private health insurance plans typically do not cover all of the costs associated with long-term care. This means that even if you have private health insurance you may still need to rely on Medicaid to help pay for some of your long-term care expenses.

How can I get more information about Medicaid in Colorado?

If you are a Colorado resident interested in learning more about Medicaid and how to apply, you can visit the state’s website or call the Medicaid office. You can also find information about Longmont’s specific Medicaid program, “Bridge to Benefits,” by visiting the city’s website.

If you are not a Colorado resident, you can still get more information about Medicaid by visiting the Centers for Medicare and Medicaid Services website or by calling 1-800-MEDICARE (1-800-633-4227).

What are some other resources for assisted living in Longmont, Colorado?

If you or a loved one are in need of assistance with activities of daily living, there are many resources available to help you find the perfect assisted living situation. In addition to the facilities listed above, many other long-term care options are available in Longmont, Colorado.

Some other resources for assisted living in Longmont include:

-The Senior Community Services Block Grant program through The Department of Health and Human Services provides funding to eligible states and localities to support a broad range of community-based services for older adults.

-The National Council on aging provides detailed information on topics such as choosing an assisted living facility, financing options, and more.

-A Place for Mom is a free service that helps families find the perfect assisted living situation for their loved ones. They have a team of expert advisors who can provide personalized assistance and referrals to facilities nationwide.

What are some tips for choosing an assisted living facility in Longmont, Colorado?

There are many things to consider when choosing an assisted living facility in Longmont, Colorado. Here are a few tips to keep in mind:

-Make sure the facility is licensed and accredited by the state of Colorado.

-Check out the facility’s website and read reviews from current and former residents.

-Ask about the staff-to-resident ratio and whether there are any RNs or LPNs on staff.

-Find out what kind of activities and amenities are offered at the facility.

-Ask about the cost of living at the facility and whether Medicaid is accepted.